Bajaj Auto, a leading player in the Indian two-wheeler market, is witnessing a shift in demand towards premium products. According to Rakesh Sharma, Executive Director of Bajaj Auto, the entry-level 100 cc segment is seeing negative growth while the executive 100 cc segment is marginally above the negative zone. On the other hand, the company's 125 cc portfolio is growing at a much faster rate compared to the lower segments.

“The entry-level itself is still seeing very sharp negative declines. Just above that, which is a quarter of the industry, the executive 100 cc segment is a little bit positive,” he said.

The top two-wheeler segment, defined with more powerful bikes of 350 cc and more, is growing at 3-4 times the rate of the bottom segment, according to the Bajaj management. This indicates that there is a demand recovery in the domestic market, with a recovery of around 3-5 percent in retail terms for the domestic motorcycle business.

“This year at least, this is going to be the story. The top half growing faster than the bottom half and hopefully the domestic motorcycle market growing at about 5-8 percent. We hope to beat that because we have got a very strong play in the top half and we have also made certain moves in the executive 100 cc segment now,” he added.

However, the ease of trading operations is expected to take some time to come back to normalcy. Despite the challenges posed by the current market situation, Bajaj Auto remains optimistic about the future as they continue to focus on delivering high-quality products to meet the evolving needs of their customers.

The strong earnings report and bullish outlook have led to several brokerages upgrading their ratings for Bajaj Auto. Investors looking for exposure to the auto sector may want to consider this stock as a potential investment opportunity.

JPMorgan has upgraded the stock to "overweight" and raised its target price to Rs 4,400. CLSA has given the stock a "buy" rating and raised its target price to Rs 4,619. Jefferies has also given a "buy" rating with a target price of Rs 4,300 and Morgan Stanley has also maintained an "overweight" rating with a target price of Rs 4,449.

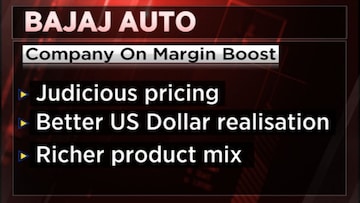

These upgrades come after Bajaj Auto reported strong earnings for the quarter, outpacing expectations and showing resilience in the midst of the ongoing pandemic. The company's earnings were boosted by a surge in demand for its two-wheelers, particularly in rural areas.

For the full interview, watch the accompanying video