Motilal Oswal Financial Services has written an interesting report where they talk about how the automobile sector is back from the brink after five years of a downturn. The going was not good for a long stretch, but now things are improving, headwinds are receding, and demand is moving up.

The auto sector has been facing challenges due to rising commodity prices in recent times. However, with a stable commodity environment, the sector is expected to recover and continue to grow. This is great news for the auto industry, which has been struggling to stay afloat amidst the COVID-19 pandemic.

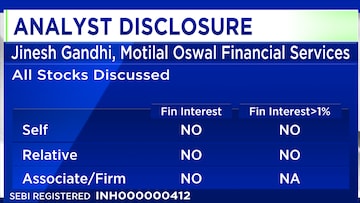

In an interview with CNBC-TV18, Jinesh Gandhi, Deputy Head of Research and Auto Analyst-Institutional Equities at Motilal Oswal Financial Services, and one of the co-authors of the report said that after the release, he believes that the auto sector is poised for growth in the coming months as stable commodity environment will support the industry.

He said, “From the tailwinds going forward, we see upside to the demand, which in turn will also be a driver of operating leverage for most of the companies, along with that stable commodity environment is also going to support the margin improvement for the auto sector.”

Gandhi also highlighted the fact that the auto sector is already showing signs of improvement. He noted that margins for the sector have been improving steadily, bouncing back from their lows. This is a promising sign for investors and stakeholders, who have been keeping a close eye on the industry's recovery.

Another area where the auto sector is expected to see growth is in commercial vehicle (CV) demand. According to Gandhi, there is continued traction in the CV demand, which will drive growth in the industry. This is particularly relevant as the demand for CVs is often considered a leading indicator of economic activity. As such, the continued growth in CV demand is a positive sign for the overall economy.

For more details, watch the accompanying video