The auto sector has seen its growth momentum slowed down in quarter four across most segments. Now dealer surveys indicate that new order inflows at passenger vehicle (PV) dealerships has slowed down while the medium and heavy commercial vehicle (MHCV) demand recovery remains on track driven by infrastructure spending. The margin improvement is also on track due to price hikes and lower commodity costs.

What are the revenue expectations this time around for the entire sector?

Brokerage firm Nomura expects a revenue growth of about 15 to 35 percent in the commercial vehicle (CV) segment, a large part of it coming in from Tata Motors and Ashok Leyland. In the 2-wheeler segment, Hero Motocorp and Bajaj Auto are expected to see a 9 to 11 percent topline growth which is slower than its peers in the other segments, while TVS Motors expected to do better with about a 20 percent growth largely because of its exposure in the electric vehicle (EV) space.

Passenger vehicle manufacturers like Maruti Suzuki as well as Mahindra and Mahindra (M&M) will see higher growth due to a low base effect of last year, a growth of around 22 to 28 percent is expected in the revenues for Maruti Suzuki and M&M.

The street will also be watching out for commentary on demand trends, which have been slowing down across segments, while another area of concern has been the export markets which have remained weak for 2-wheelers.

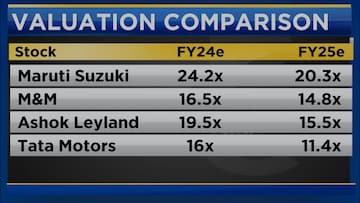

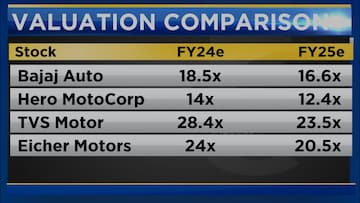

Valuation table for FY24 and FY25

Within the passenger car space, M&M is still inexpensive compared to peers like Maruti. M&M still trading at around 15 times FY25 compared to Maruti at about 20 times.

From the 2-wheeler space, Hero Motocorp is still the cheapest stock trading at a 20 percent discount to its own historic average and compared to its peers as well, because of rising competitive intensity and a loss of market share in its core motorcycle segments.

According to Jay Kale, the Senior VP-Research at Elara Capital, there is a slowdown in demand.

“In terms of the momentum on ground, definitely after a very strong nine months or maybe six months till festive, things have slowed down to a certain extent which was expected,” he said.

For more details, watch the accompanying video