The US dollar held just below multi-decade peaks on Tuesday as traders awaited a rate hike from the US Federal Reserve.

Market participants feel a 75 basis-point Fed hike seems like a done deal, but wonder whether hints of a slowing economy may prompt a shift away from its focus on inflation.

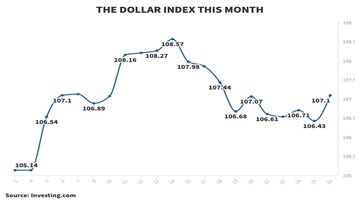

The

dollar index is at 107.08, not too far below a 20-year high of 109.29. Fears of recession and expectations of further rate hikes by Fed to battle record high inflation has allowed dollar to be a safe haven.

In an interview to CNBC-TV18, Jonathan Schiessl, Deputy CIO, at Westminster Asset Management, said if there is any indication of Fed easing off on rate hikes then dollar could start reversing quite rapidly.

“The

dollar has been incredibly strong over the last few months but we have seen some reversal in that strength over the last week or so. I guess the Fed commentary and everything else is going to be critically important for the movement in the dollar. The moment the market does get any indication that the Fed will perhaps change course and might ease off the accelerator of rate rises etc, then I would anticipate the dollar to start reversing quite rapidly at that stage.”

However, Paul Schulte, Founder & Editor of Schulte Research, believes that the Fed is facing a credibility problem right now and might end up over tightening which may lead to a liquidity crisis.

“The Fed has a very strong credibility problem right now and so they are going to end up over tightening. However Fed is going to have to watch out for a liquidity crisis if it hikes rate by another 50 or 75 basis points after tomorrow's 75 basis points hike.”

Market participants say if Fed signals slowing down the pace of hikes, then it would be read as dovish. While if the Fed signals another 75 bps hike, it would be a hawkish surprise.

Watch video for more.