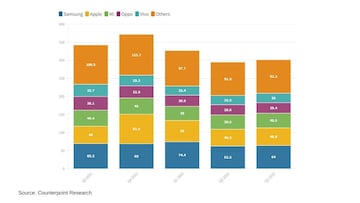

The global smartphone market remained under pressure given deteriorating economic conditions, with shipments declining by 12 percent year-on-year (YoY). Smartphone shipments reached 301 million units in the third quarter of 2022, according to Counterpoint’s Market Monitor service.

Ongoing geopolitical tensions, resulting in economic uncertainty, hit the smartphone market even though it reversed its slide below the 300-million-mark in the last quarter thanks to a slight quarterly recovery in Apple and Samsung shipments, the report added.

Commenting on overall market dynamics, senior analyst Harmeet Singh Walia said, “Most major vendors continued experiencing annual shipment declines in the third quarter of 2022. Russia’s escalating war in Ukraine, ongoing China-US political distrust and tensions, growing inflationary pressures across regions, a growing fear of recession, and weakening national currencies all caused a further dent in consumer sentiment, hitting already weakened demand.”

He added that this is also adding to a slow but sustained lengthening of smartphone replacement cycles, with smartphones becoming more durable as technology advancement slows. This is accompanying a fall in the shipments of mid- and lower-end smartphones, even as the premium segment weathers the economic storm better.

Owing to an earlier launch of the latest iPhone series this year, Apple emerged as the only top five smartphone vendor to manage annual shipment growth in the quarter.

Samsung grew quarter-on-quarter in Q3 2022, thanks to record pre-sales of its premium Fold and Flip smartphones, compared with the same quarter last year. However, its shipments fell by 8 percent YoY.

This is primarily due to dampening consumer sentiment in several of its key markets. This also affected top Chinese brands, whose shipments remained low compared with last year as they were getting rid of excess inventory and at the same time managing a slowdown in the home market. However, they were able to capitalise on Apple and Samsung’s exit from the Russian market, in which China's share increased substantially.

Jan Stryjak, Associate Director, Counterpoint, said he expects a further quarterly improvement in the coming quarter, although central banks’ attempts to control inflation will further reduce consumer demand.

“The channel inventory is still higher, and the OEMs will focus on getting rid of excess inventory in Q4 as well. Hence, shipments are unlikely to reach last year’s levels, let alone pre-pandemic Q4 levels of over 400 million units. Looking further ahead into 2023, we expect sluggish demand with lengthening replacement rates, especially in the first half of the year,” he added.

*OPPO includes OnePlus from Q3 2021

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM