2022 has been a good year for India's residential real estate market despite the emergence of the Omicron variant of COVID-19 and according to Murtuza Arsiwalla, director, Kotak Institutional Equities, this party is not over yet.

“Whether it's the price increase, which is driving the demand, or the demand, which is driving the price increase... Whichever way, the party seems to continue as far as residential real estate goes so far,” Arsiwalla said in an interview with CNBC-TV18.

Overall, India's residential real estate market has seen a consistent improvement in sales for the past few quarters.

Knight Frank, a real estate agency, in a report, stated that 78,627 residential units were sold in the country in the March 2022 quarter, a four-year high, despite Omicron cases rising, leading to another wave of COVID-19. On a year-on-year basis, this was a growth of 9 percent.

Knight Frank India's latest report showed that Mumbai (BMC area) saw property sale registrations of 11,339 units in July 2022, the highest in a decade for July month. Over half of registrations were in the price band of Rs 1 crore. In terms of apartment size, highest demand was seen for homes ranging between 500 and 1000 sq ft.

Several players other than Godrej Properties have played catch-up in the Mumbai market, according to Arsiwalla.

“So, while Godrej Properties continues to clock consistent sales numbers, there have been several other players in DLF, in Lodha, in Prestige, which play catch-up and the underperformance is readjusting the premium that Godrej Properties enjoyed because you have got other alternatives which do an equal amount of sales. So it is more relative rather than absolute,” he said.

According to a recent Anarock report, sales of luxury apartments — priced at over Rs 1.5 crore — stood at 25,680 units across seven major cities during January-June 2022, surpassing yearly sales in the previous three years.

It said the luxury home market has done "remarkably well" this year, aided by developer discounts and demand from non-resident Indians (NRIs).

With better demand for independent floors, DLF recently said it is targeting about Rs 1,300 crore sales revenue from its new luxury housing project at Panchkula in Haryana.

“We are developing 424 independent floors in this project. The construction work will start after the monsoon season and the project will get completed in the next three years,” DLF’s Group Executive Director and Chief Business Officer Aakash Ohri told PTI.

In a conversation with CNBC-TV18, Ashok Tyagi, Whole-Time Director at DLF, said that the company

might consider raising rates depending on the absorption pace of the current price points.

Arsiwalla is constructive on the residential real estate space including DLF. He believes the consumer continues to shift in favour of the stronger and better-organised developers. The reasons are the upcycle and market share gains that one gets with large set of listed players.

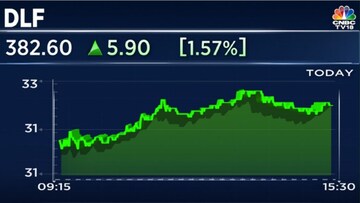

As of August 25

IIFL Securities on August 23 also said that the strong momentum in the residential real estate market is likely to continue with developers bullish on medium term outlook.

It added that the market players are aggressively looking to expand into newer markets. DLF and Lodha remain its top picks among the residential market players.

First Published: Aug 26, 2022 1:48 PM IST

As of August 25

As of August 25