1 / 6

1 / 6The rights for TV and broadcast will fetch the BCCI more than Rs 44,000 crore. This is 45 percent higher than the base price set for the auction and more than double the Rs 16,300 crore paid by Disney and Star in 2017.

2 / 6

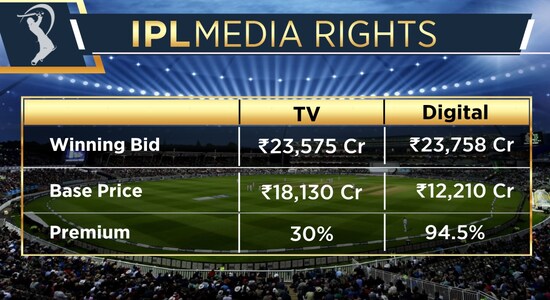

2 / 6TV rights were sold for more than Rs 23,500 crore. This is at a 30 percent premium over the base price set by the BCCI, which was just over Rs 18,000 crore. Digital rights were sold for a premium of nearly 70 percent. From a base price of Rs 12,200 crore, digital rights were sold for Rs 20,500 crore.

3 / 6

3 / 6And with this, the Indian Premier League (IPL) has pipped the English Premier League. The cost to broadcast one IPL match is now more than $13 million. Only the National Football League in the United States is more "expensive" than the IPL, as things stand.

4 / 6

4 / 6It's worth noting that the BCCI will only get 50 percent of the money as per the revenue-sharing model. All the IPL teams can look forward to a big payday as they get the remainder of the money from the broadcast deals.

5 / 6

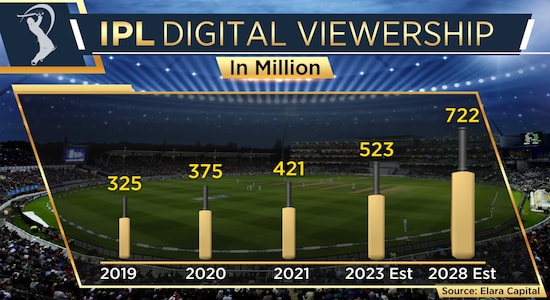

5 / 6How lucrative are the IPL rights for broadcasters? Elara Capital believes broadcasters are likely to break-even only by the fourth year of the five-year contract with the BCCI. But they expect digital to grow at over 30 percent. Digital viewership has only been growing. From just over 300 million in 2019, digital viewership was at 421 million last year and is expected to cross 520 million next year. In fact, digital viewership is expected to hit 720 million by 2028.

6 / 6

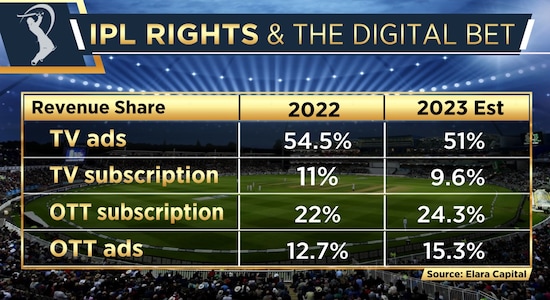

6 / 6Digital players are also projected to clock solid growth in revenue via subscription and advertisements while TV players are likely to see a decline. Television advertisements contributed to more than 54 percent of the revenue and this is expected to decline to 51 percent. Subscription revenue for TV is also expected to see a marginal decline. On the other hand, over the top, or OTT, players are likely to see growth in both subscription and advertisement revenues. This might explain why digital rights were sold for a premium of nearly 70 percent compared to a 30 percent premium for TV rights.