1 / 9

1 / 9Zomato, one of the top 5 unicorns of India, is a platform that has successfully managed to connect restaurants and customers. By using technology and a fleet of delivery partners, Zomato has created a capital-light compounding machine which creates an eco-system wherein restaurants make more money, customers enjoy convenience along with quality products and delivery partners enjoy part-time income. Brokerage house IDBI Capital believes, Zomato will continue to lead the food services industry in India. Here's all you need to know about Zomato and its IPO in charts. (Image: Shutterstock)

2 / 9

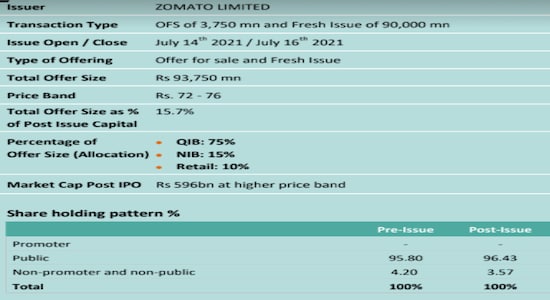

2 / 9Zomato IPO opened on July 14 and will close on July 16. The price band of the issue has been set at Rs 72-76 and it is a combination of both fresh issue as well as offer for sale by existing promoters and shareholders.

3 / 9

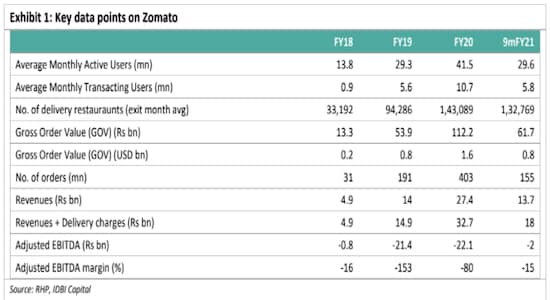

3 / 9Key Data Points: Starting 2015, Zomato ventured into the food delivery business acting as a food aggregator. Food delivery is now the major growth driver for Zomato contributing 80 percent to FY20 revenue. Zomato is now one of the leading food aggregators in India with a GMV of $1.5 billion and monthly active user at 42 million as on FY20.

4 / 9

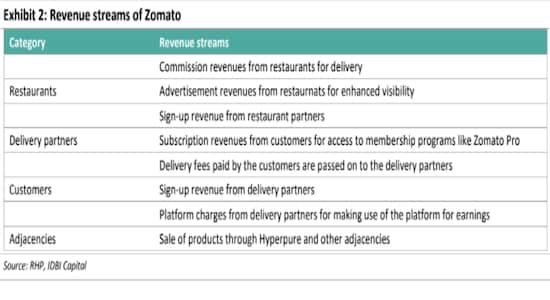

4 / 9Revenue Streams: The firm gathers revenues from restaurants, delivery partners, customers and adjacencies.

5 / 9

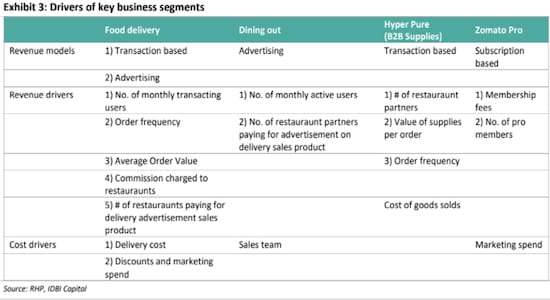

5 / 9Drivers: The revenue model of the firm is based on transaction, subscription and advertisement. Meanwhile, the revenue drivers include the number of monthly transactions, order frequency, average order value, no of restaurant partners and membership fees of pro members.

6 / 9

6 / 9Delivery Partners: Zomato’s provides earnings opportunities to 1.69 lakh delivery partners.

7 / 9

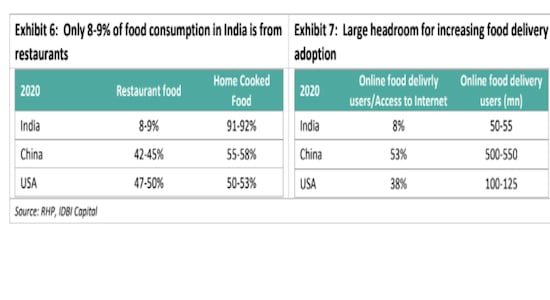

7 / 9Food service industry in India is highly underpenetrated. Zomato is primarily competing with home-cooked meals!

8 / 9

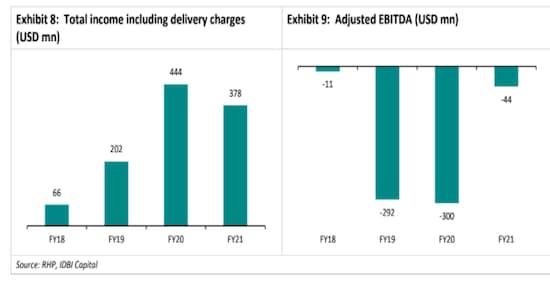

8 / 9Total income including delivery charges rose 7 times during FY18-20 while EBITDA losses declined significantly.

9 / 9

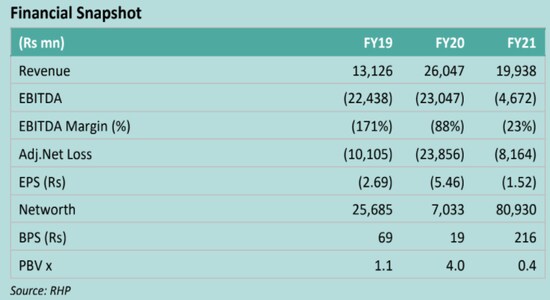

9 / 9Financial snapshot: Here's a look at Zomato's finances between FY19 and FY21.