1 / 11

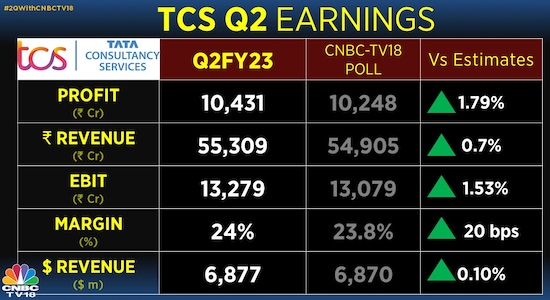

1 / 11TCS reported a quarterly net profit of more than Rs 10,000 crore for the first time ever, boosted by healthy demand across verticals. Analysts in a CNBC-TV18 poll had estimated the IT major's net profit at Rs 10,248 crore. (Read more on TCS results)

2 / 11

2 / 11The top helm of the country's second largest company by market value said TCS is well placed without any sign of a customer pullback. "We are comfortable with deal band guidance of $7-9 billion," CEO Rajesh Gopinathan said.

3 / 11

3 / 11TCS CFO Samir Seksaria said the company is steadily making its way towards achieving its operating margin priority for the year, aided by leverage from good growth, the flattening of the workforce pyramid, steadily improving productivity and currency support. TCS clocked an operating margin of 24 percent for the three-month period, as against an estimate of 23.8 percent by analysts in a CNBC-TV18 poll.

4 / 11

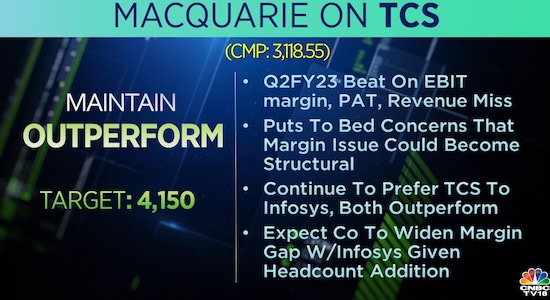

4 / 11Macquarie believes that the IT company's quarterly performance puts to rest concerns about the margin issue turning into a structural problem. The brokerage continues to prefer TCS to Infosys. It has an 'outperform' rating on both the stocks.

5 / 11

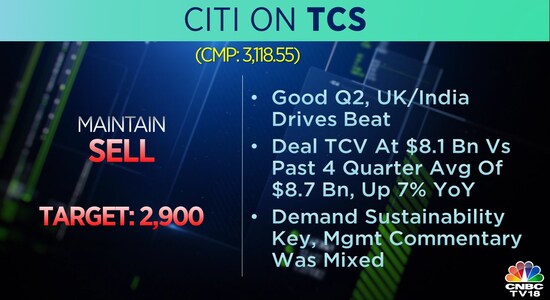

5 / 11Citi said the TCS management commentary was mixed, maintaining a 'sell' rating on the stock with a target price of Rs 2,900 — implying a downside of 7.1 percent from Monday's closing price.

6 / 11

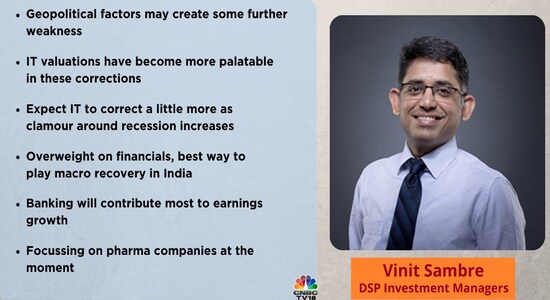

6 / 11Vinit Sambre of DSP Investment Managers told CNBC-TV18 that IT valuations have become more palatable in his view. He sees some more weakness in the market on account of geopolitical factors but is also of the view that the current consolidation is good for long-term investors.

One can expect the IT space to "correct a little more as clamour around recession increases", he said.

7 / 11

7 / 11Credit Suisse raised its earnings per share estimates for the three years ending March 2025 by 2-4 percent citing better margin and currency benefits. The brokerage acknowledged strong revenue growth and margin expansion in the July-September period but said the demand scenario remains uncertain for the year ending March 2024.

8 / 11

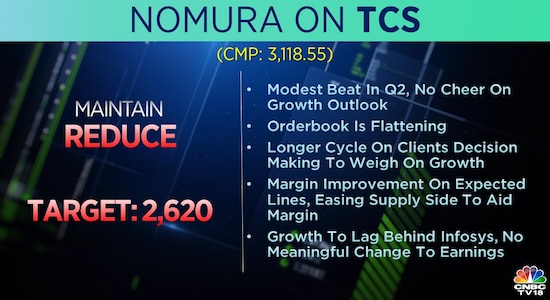

8 / 11Nomura continued with its 'reduce' call on TCS shares with a target price implying 16 percent downside potential from Monday's price, citing a flattening orderbook. The brokerage said growth in TCS is expected to lag behind Infosys with no meaningful change to earnings.

9 / 11

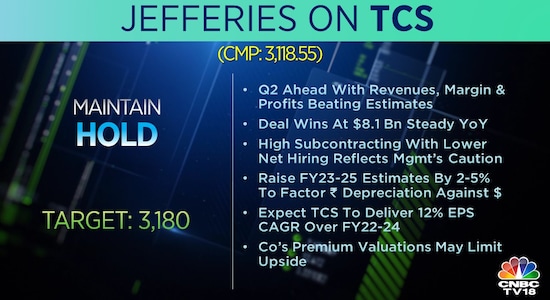

9 / 11Jefferies retained its 'hold' call and target price of Rs 3,180 for TCS, citing premium valuations. The brokerage, however, raised its earnings estimates for the IT giant for the three years ending March 2025 taking into account the rupee weakness.

10 / 11

10 / 11CLSA said Tata Consultancy Services' long-term demand outlook has softened but not at alarming levels. Its ability to structure large cost-takeout deals should help it gain market share, according to the brokerage.

11 / 11

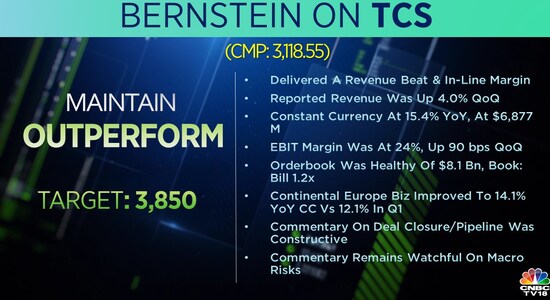

11 / 11Bernstein's target price for TCS implies 15% upside potential from Monday's level.