1 / 10

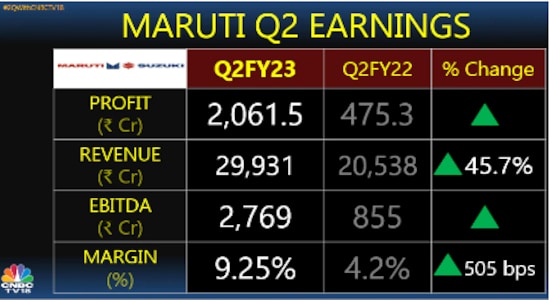

1 / 10Maruti Suzuki's net profit for the quarter surpassed street expectations, while the topline and operating performance met estimates. Volumes increased 36.3 percent from last year to 5.17 lakh units.

2 / 10

2 / 10While most brokerages are bullish on India's largest carmaker, a few analysts have red-flagged slow growth for the passenger vehicles industry in the next fiscal.

3 / 10

3 / 10Jefferies | The brokerage has given a 'buy' rating to Maruti and raised the target price to Rs 12,000 per share as volume rose to an all-time high while EBITDA per vehicle jumped 31 percent sequentially.

4 / 10

4 / 10UBS | The global brokerage also has a 'buy' call on Maruti noting that earnings beat estimates and things are expected to keep improving for the automaker.

5 / 10

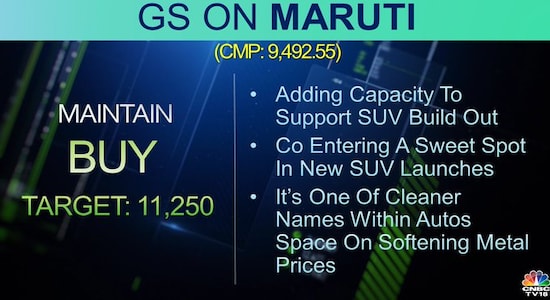

5 / 10Goldman Sachs | The brokerage suggests buying Maruti as it sees the carmaker as one of the cleaner names within the auto space on softening metal prices.

6 / 10

6 / 10Citi | The brokerage has raised its target price on the company’s stock to Rs 12,500 per share with a 'buy' rating as it has a positive volume outlook with a strong orderbook.

7 / 10

7 / 10JPMorgan | It has a 'neutral' call on the carmaker but raised the target price to Rs 8,700 as it says the stock is pricing in the continued margin expansion. It has also increased FY23-25 earnings per share estimates by 3-4 percent to factor slightly higher margin.

8 / 10

8 / 10CLSA | Unlike others, this brokerage has a 'sell' call on the company with a target price of Rs 7,597 on its shares following a “punchy” quarter that saw strong improvement in profitability. It said bookings are currently very strong and noted that the company does not expect any major commodity cost savings in the second half of the fiscal. The brokerage is of the view that the passenger vehicle industry’s growth shall be slow in the 2023-24 financial year.

9 / 10

9 / 10Kotak Institutional Equities | This one too has a 'sell' call with a target price of Rs 8,150 per share. According to the brokerage, EBITDA was below estimate due to lower-than-expected gross margin. It expects RM tailwinds and favourable FX to support margin recovery. The brokerage sees EBITDA margin remaining below 12 percent in FY24-25. It also believes that it will be challenging for the firm to cross 45 percent market share.

10 / 10

10 / 10Edelweiss | The brokerage said that Maruti EBITDA’s came in above its estimate but it could have been higher if not for higher-than-expected marketing spends. Given the excitement around Grand Vitara and Brezza, the Yen depreciation and subdued commodity benefit, it has raised its EPS estimate by 5 percent for FY23 and FY24 each.