1 / 6

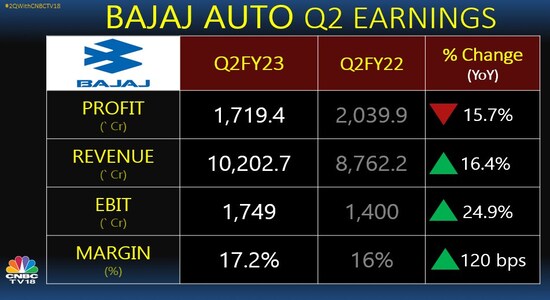

1 / 6Bajaj Auto's revenue exceeded the Rs 10,000 crore mark for a quarter for the first time ever — a jump of more than 16 percent compared with the corresponding period a year ago.

2 / 6

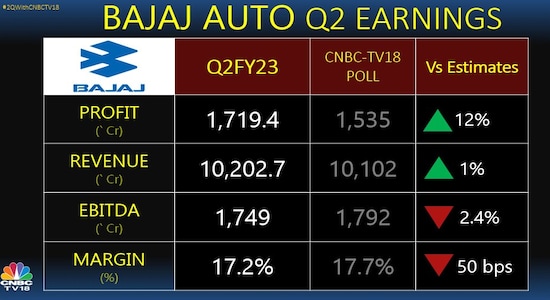

2 / 6Bajaj Auto's domestic volumes nearly doubled sequentially, but exports declined due to a deteriorating macroeconomic environment in the overseas markets Its margin — a key measure of profitability — improved by 120 basis points on a year-on-year basis but failed to meet analysts' estimate of 17.7 percent.

3 / 6

3 / 6CLSA's target price for Bajaj Auto shares implies nearly 15 percent upside potential from Friday's closing price. Although the brokerage retained its 'outperform' rating on Bajaj Auto, it lowered its earnings estimates for the auto company for two years ending March 2024 by 2-6 percent citing lower volume and margin.

4 / 6

4 / 6Goldman Sachs continued with its 'buy' call on the stock with a target price of Rs 4,500 — citing 26 percent upside potential in the stock. The brokerage said improving semiconductor supply is helping the company recover its market share. It expects normalisation of raw material cost and inflection in three-wheeler volumes to aid the company's margin going forward.

5 / 6

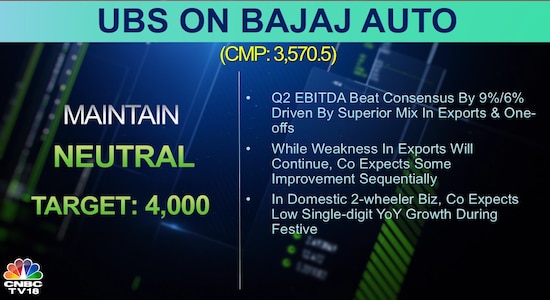

5 / 6UBS said Bajaj Auto's superior mix in exports helped it beat consensus estimates but weakness in exports is likely to persist. The brokerage's target price implies a 12 percent upside in the stock.

6 / 6

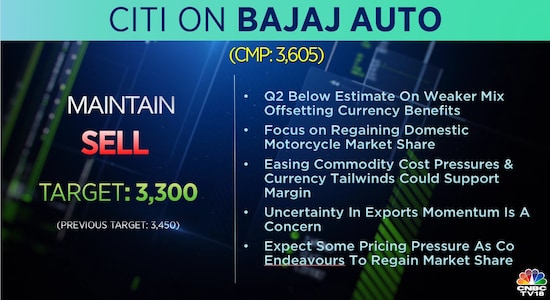

6 / 6Other analysts are not as optimistic. Citi retained a 'sell' call on Bajaj Auto after the earnings announcement, lowering its target price by 4.3 percent to Rs 3,300. Uncertainty in exports is a concern for Bajaj Auto even as easing commodity costs and currency tailwinds could support its margin, according to the brokerage.