A systematic Investment Plan (SIP) — a way of investing in mutual funds — gives a possibility of earning high returns. However, it is extremely vital to choose the duration of SIP carefully.

Live TV

Loading...

When talking about duration, investors often confuse SIP tenure and investment holding period. It's vital to note here that in mutual funds, there are SIPs that have only three years of tenure, but one can extend and hold them for longer periods.

So, what should be the ideal duration for investment?

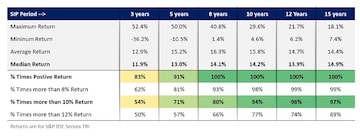

WhiteOak Capital Mutual Fund (MF) has come up with some data showing returns for the SIP periods of 3, 5, 8, 10, 12 and 15 years. These are based on S&P BSE Sensex TRI and show median return, percent times positive return, percent times more than 8 percent, 10 percent and 12 percent returns.

The result can be seen here:

These returns, as WhiteOak Capital said, are for SIPs between September 1996 to September 2020. The data shows that the longer the investment horizon, the higher the probability to get positive returns.

A longer tenure averages out the crests and troughs of the investment, while shorter tenures can give high rewards but high risks too.

Empirically also, it takes at least five years to average out the losses and market risks and the power of compounding acting in the back in terms of investing in a SIP. Hence, one should consider SIPs with a minimum investment of five years or so, experts say.

Factors to consider before investing

Before investing in a mutual fund, it is important for individuals to assess their preferences like financial goals and risk tolerance. The horizon would totally depend on what the goal is and by what time investors wish to fulfil it.

Investing via SIP is advisable for those investing in equity instruments for the first time and for those who want some financial discipline. While a lump sum investment can put the investor at risk of catching a market peak, a SIP allows them to spread investments over time and invest at different market levels.

SIP is a good way of accumulating mutual fund units periodically and over market cycles to create long-term wealth.

First Published: Oct 7, 2022 4:47 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: From Wayanad to Shivamogga, key battles in the second phase

Apr 25, 2024 2:01 PM

EC probes allegations of MCC violation by Modi, Rahul; seeks response by April 29

Apr 25, 2024 1:32 PM

LS polls phase 2: Rahul Gandhi, Shashi Tharoor in fray; Hema Malini, Om Birla eyeing hat-trick

Apr 25, 2024 12:19 PM

UP constituencies to witness three-cornered fight in second phase tomorrow

Apr 25, 2024 10:47 AM