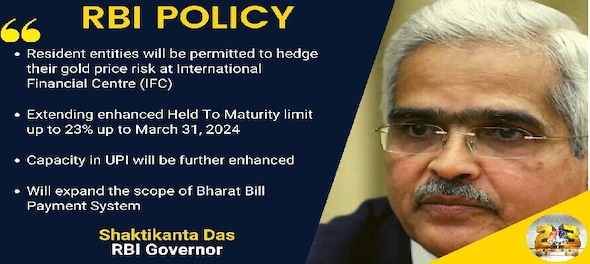

Resident entities will now be permitted to hedge their gold price risk on recognised exchanges in the International Financial Services Centre (IFSC), Reserve Bank of India (RBI) governor Shaktikanta Das said while making Monetary Policy Committee (MPC) announcements on Wednesday, December 7. This will provide greater flexibility to resident entities in India to hedge the price risk of their gold exposures efficiently, Das said.

Live TV

Loading...

The related instructions will be issued separately, the RBI said.

What exactly is gold hedging?

Gold is often used to hedge macroeconomic events, such as inflation, deflation, and currency devaluation, potentially enabling investors to preserve their wealth.

What does the current rule say?

As of now, resident entities in India are not permitted to hedge their exposure to gold price risk in overseas markets.

Who will benefit from the rule change?

According to Colin Shah, MD at Kama Jewelry, this is a positive move and a major enabler for gold importers and exporters using yellow metal as the primary raw material for production.

"This will help increase the price competitiveness of the Indian jewellery industry. It will help players hedge their positions against price fluctuations and unfavourable currency movement. This will also lead to an increase in volumes and activities at IFSC," he said.

About RBI policy

Meanwhile, RBI has raised the benchmark lending rate by 35 basis points to 6.25 percent in a bid to tame inflation. This is the fifth consecutive rate hike after a 40 basis points increase in May and 50 basis points hike each in June, August and September. In all, the RBI has raised the benchmark rate by 2.25 percent since May this year.

The six-member Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das decided by majority view in favour of the rate hike.

The Consumer Price Index (CPI) based inflation, which RBI factors in while fixing its benchmark rate, stood at 6.7 percent in October. Retail inflation has been ruling above the RBI's comfort level of 6 per cent since January this year.

First Published: Dec 7, 2022 11:36 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Chhattisgarh Lok Sabha elections 2024: Bhupesh Baghel among the list of Congress candidates

Apr 19, 2024 3:45 PM

Chhattisgarh Lok Sabha elections 2024: Full list of BJP candidates

Apr 19, 2024 1:46 PM

Lok Sabha Election Phase One: WB records 51% voting, UP 37%, Maharashtra 32% till 1 pm

Apr 19, 2024 12:56 PM

Violence mars first phase of Lok Sabha polls in West Bengal

Apr 19, 2024 12:09 PM