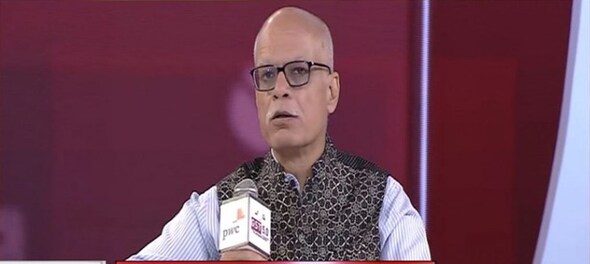

Revenue Secretary Tarun Bajaj on Tuesday said that personal income tax regime needs a complete reinvent and government should come up with something new and only one regime rather than having two regimes.

Live TV

Loading...

“The aim should not be to increase the tax rates, even if it is revenue neutral or even if it gives up some revenue if it makes it simple. If there are less exemptions or exemptions are simple, and if you make more money than me, you pay more taxes. If I make less money than you I pay less taxes and not vice versa, which is the situation right now,” he said, adding that some people who take benefit of a lot of exemptions today will be the losers.

Although the official said that his view was independent of the preparations under way for Budget FY24, he iterated that there was also a pressing need to align the capital gains’ tax rates and holding periods across asset classes to minimize the room for market-distorting tax arbitrage amongst products.

Bajaj said in personal income tax, minimal exemptions should be given and the tax brackets should be expanded.

"For instance, the tax bracket (for 20 percent tax) can be from Rs 5 lakh-15 lakh instead of Rs 5 lakh-10 lakh. This can be a revenue-neutral exercise and the regime will be simpler,” he was quoted as saying by a Financial Express report.

“That is what we have done in the corporate tax, where it has been brought down to 22 percent without exemptions and now about 70 percent of the total income of the corporate sector has moved into this though the number of players is much less, they are about close to 20 percent. But 70 percent of the income has moved there. As we move from year on year, the 70 percent figure will start touching 100, it will go to 200 and the same thing would happen for the personal income tax,” Bajaj added.

He also said while certain exemptions such as insurance premium for senior citizens would still be needed, most such concessions could go.

“Small savings give better interest rates and tax exemption also,” he said.

The Revenue Secretary also spoke about India’s capital gains tax regime, which he said is complicated and needs simplification.

From 2020-21 onwards, the Budget gave an option of a lower personal income tax regime to those earning up to Rs 15 lakh, provided they forgo some exemptions.

With these, we have two tax regimes as of now.

Under the new tax regime, 7 income slabs are available.

Annual income up to Rs 2.5 lakh is exempt from tax. Those individuals earning between Rs 2.5 lakh and Rs 5 lakh have to pay 5 percent tax. Income between Rs 5 and 7.5 lakh is taxed at 10 percent, while those between Rs 7.5 and 10 lakh at 15 percent.

Those earning between Rs 10 and 12.5 lakh have to pay tax at the rate of 20 percent, while those between Rs 12.5 and Rs 15 lakh have to pay at the rate of 25 percent. Income above Rs 15 lakh is taxed at 30 percent.

Here’s a comparison between both the regimes:

| New tax slab rates | Old tax slab rates | ||

|---|---|---|---|

| Income from Rs 2.5 lakh to Rs 5 lakh | 5% | Income from Rs 2.5 lakh to Rs 5 lakh | 5% |

| Income from Rs 5 lakh to Rs 7.5 lakh | 10% | Income from Rs 5 lakh to Rs 10 lakh | 20% |

| Income from Rs 7.5 lakh to Rs 10 lakh | 15% | Income above Rs 10 lakh | 30% |

| Income from Rs 10 lakh to Rs 12.5 lakh | 20% | ||

| Income from Rs 12.5 lakh to Rs 15 lakh | 25% | ||

| Income above Rs 15 lakh | 30% | ||

(Edited by : Anshul)

First Published: Nov 30, 2022 9:47 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

UP constituencies to witness three-cornered fight in second phase tomorrow

Apr 25, 2024 10:47 AM

BJP MP's wife challenges him in electoral battle for Etawah seat

Apr 25, 2024 9:39 AM