ICICI Prudential Mutual Fund has recently launched ICICI Prudential Nifty IT Index Fund. This is an open-ended index scheme replicating the Nifty IT index by investing in a basket of Nifty IT stocks and aims to achieve returns of the stated index, subject to tracking error. The new fund offer (NFO) is open until August 11, 2022.

Live TV

Loading...

The minimum application amount during this NFO is Rs 1,000. The offering will be managed by Kayzad Eghlim and Nishit Patel.

About the fund

ICICI Pru IT Nifty Index Fund is 10 stock index fund with 53.2 percent allocation to the top two IT bellwethers — Infosys and TCS and the remaining allocation to other domestic names. The top 5 stocks comprise 80 percent of total index constituents.

Why IT fund?

Over the years, the IT sector tends to rebound stronger after any crisis such as the subprime mortgage crisis, taper tantrum and COVID-19 pandemic. Also, IT is one of the sectors that stand to benefit from rupee depreciation as a large part of its revenue comes from export to the US markets, according to the fund house.

In terms of performance, over the past decade, Nifty IT TRI has outperformed Nifty 50 TRI by delivering 18.4 percent compound annual growth rate (CAGR) as compared to 12.9 percent CAGR of Nifty 50.

(Source: ICICI Prudential Mutual Fund)

So, should one invest?

According to Amar Ranu, head of investment products and advisory, Anand Rathi Shares & Stock Brokers, it is a highly concentrated IT portfolio at an efficient cost.

“However, other actively managed IT/Tech funds have better portfolio diversification relative to this fund, but it comes at a higher cost,” Ranu said.

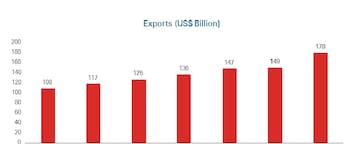

Exports of the Indian IT industry have grown by 65% in 7 years

(Source: ICICI Prudential Mutual Fund)

On performance, he said that IT being the focus across the globe, has been in long demand and has created a space in the investment portfolio for themselves, and it further accelerated during the COVID times when there was a demand for technology enhancements for most of the companies.

"However, amid weakening macro-economic environment, there has been margin pressure including high attrition rates in recent quarters for most of IT companies. Unlike in the past, where we saw higher double-digit growth, we expect the sector to report low teen growth shortly but maintain a positive stance over the medium term," Ranu said while talking to CNBC-TV18.com.

Who should invest here?

Investors with high-risk appetites and orientation towards IT can take a small allocation in their tactical part of the overall portfolio cost-efficiently. This should not be a part of strategic portfolio allocation, Ranu told CNBC-TV18.

Note To Readers

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Haridwar Lok Sabha elections: Tight contest between BJP, BSP, and Congress

Apr 19, 2024 10:33 AM

Udhampur Lok Sabha election: Voting underway, over 16.23 lakh voters to decide fate of 12 candidates

Apr 19, 2024 10:21 AM