ICICI Prudential Mutual Fund has announced the launch of ICICI Prudential Nifty Pharma Index Fund, an open-ended Index scheme replicating Nifty Pharma Index. The Index is designed to reflect the behaviour and performance of the companies that are engaged in the manufacturing of pharmaceuticals and biotechnology companies.

Live TV

Loading...

The new fund offer (NFO) will be available for subscription till December 9, 2022.

Speaking on the launch of the product, Chintan Haria, Head- Product Development & Strategy, ICICI Prudential AMC said, “Pharma sector in India continues to flourish on the back of health schemes introduced by the government, increase in exports and growing domestic demand. Going forward, greater awareness, changing attitude towards preventive healthcare, increased precedence of lifestyle diseases and better access to insurance is likely to further boost the pharma industry. By investing in ICICI Prudential Nifty Pharma Index Fund, an investor gets to tap into the opportunities presented by the pharma sector."

Over the years, India has emerged as a pharmacy to the world by being the largest provider of generic drugs globally and exporting pharmaceuticals to over 200+ countries. Also, 70 percent of World Health Organisation’s vaccines (as per the essential Immunization schedule) are sourced from India. India is also home to the second highest number of US FDA approved plants outside the US and is the 3rd largest industry worldwide in terms of production by volume and 14th by value.

Some of the growth drivers for the sector are as follows:

Government Support – As per the Union Budget 2022-23, US$ 4.83 billion has been allocated to the 'National Health Mission’

Medical tourism – Quality services at marginal costs compared to the US, Europe and South Asia.

Skilled drug manufacturing – Low-cost generic patented drugs as well as end-to-end manufacturing

High domestic demand - Launch of one of the largest National Health Protection Schemes globally

About the Index

The index includes companies which are into generic drugs, OTC medicines, bulk drugs, vaccines, contract research & manufacturing, biosimilars and biologics. The universe for stock selection is Nifty 500 and no single stock shall be more than 33 percent. Weights of top three stocks cumulatively will not be more than 62 percent at the time of rebalancing. The index will be rebalanced semi-annually on January 31 and July 31.

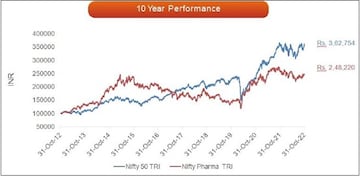

Index Performance

The Nifty Pharma Index has grown at 9.52 percent annually since October 2012. For example, Rs 1,00,000 invested in the Nifty Pharma Index in 2012 would be worth Rs 2,48,220 by end of October 2022.

(Data as on October 31 2022. Data source: MFI Explorer. Figures in the chart are rebased to 100000. Past performance may or may not be sustained in the future. The performance of the indices is the Total Return variant of the Index. The performance of the index does not signify the performance of the scheme)

Why should investors consider ICICI Prudential Nifty Pharma Index Fund?

ALSO READ | Fixed deposit interest rates back to 2019-20 level? Check if the time is right to park your money

(Edited by : Anshul)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: From Wayanad to Shivamogga, key battles in the second phase

Apr 25, 2024 2:01 PM

EC probes allegations of MCC violation by Modi, Rahul; seeks response by April 29

Apr 25, 2024 1:32 PM

LS polls phase 2: Rahul Gandhi, Shashi Tharoor in fray; Hema Malini, Om Birla eyeing hat-trick

Apr 25, 2024 12:19 PM

UP constituencies to witness three-cornered fight in second phase tomorrow

Apr 25, 2024 10:47 AM