Investing creates money for your future. The sooner you start, the longer you can compound money. The amount that you invest will grow substantially over time as you earn interest and receive dividends. Hence, it’s important to take the plunge when you are young.

Live TV

Loading...

Additionally, when you are young you have the flexibility and time to study investing and learn from accomplishments and letdowns. You risk appetite is high.

On top of that, even if you go wrong with your investments, you will have ample time to amend your mistakes and recover from them.

But before taking the shot, you should understand the basic tenets of investments.

How to start investing?

Depending upon the risk profile and objectives, youths can choose different forms of investment.

In the words of Harsh Jain, co-founder and COO of investment platform Groww, investing goals should be clear before diving in.

“First-time investors should be aware of their long-term and short-term goals. How much corpus they are looking to raise for these goals and how much risk they are willing to take to reach them,” he said.

They should also factor in inflation while calculating the corpus needed.

"Once they are sure of what category of funds they are going with, they can compare the performance of schemes against other similar schemes and also against the benchmark," Jain added.

There are chances that an individual may start investing but they may not be able to continue with it. So, it’s important to understand that regular investing is imperative.

Experts also point out that investments should always be balanced across equity and debt based on the objectives.

Where to start investing?

There are several investment options available in the market for beginners. These are:

Mutual funds

Financial advisers say that the best way to start an investment is through a systematic investment plan (SIP) in a mutual fund (MF). Mutual funds are professionally managed, transparent, liquid and provide low-cost investment options.

With SIPs, you invest regularly a fixed sum in MFs. This inculcates a habit of regular saving and investing and hence build a financial discipline in the life of the investor. It can be started with an amount as low as Rs 500.

SIP allows you to put the money at different levels of the market cycle. This helps in long-term wealth creation and the plus point is that since you are young, you have the time. At times when the markets are high, the monthly SIP would buy fewer units and when the markets are low, the same monthly SIP amount would buy more units.

Here are 3-year and 5-year returns of some mutual funds

| Fund name | Crisil Rating | AUM | 3-year returns | 5-year returns |

| SBI Contra Fund - Direct Plan - GrowthContra Fund | 5 | 5,291.25 | 30.32% | 15.87% |

| Aditya Birla Sun Life Tax Plan - Direct Plan - GrowthELSS | 4 | 371.51 | 11.99% | 8.34% |

| Bank of India Tax Advantage Fund - Direct Plan - GrowthELSS | 4 | 608.62 | 26.59% | 16.89% |

| HDFC Tax Saver Fund - Direct Plan - GrowthELSS | 4 | 9,408.98 | 17.96% | 10.05% |

| IDFC Tax Advantage (ELSS) Fund - Direct Plan - GrowthELSS | 5 | 3,692.39 | 24.93% | 15.27% |

(Source: Moneycontrol)

Stock markets

According to Clear, investing in stock markets gives you a chance to earn the highest returns among all investment options. As you have age on your side, you can invest with a long-term investment horizon. This will tackle the market volatility and benefit you in the long run.

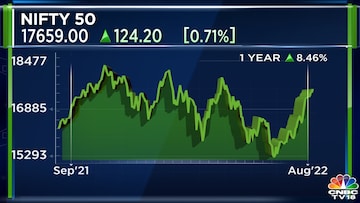

(Nifty50 chart showing performance in last 1 year)

Public Provident Fund (PPF)

PPF is a long-term saving scheme devised by the government of India. Apart from offering a high-interest rate, they are a great way to make tax-free savings. At maturity, the capital, Interest, and proceeds are all tax-free.

Since this is a long term investment option, it’s best to start investing in it when you are young, experts opine.

Unit-Linked Insurance Plans (ULIPs)

ULIPs are a great pick if you are young.

"Being an investment plan that also offers insurance coverage, ULIPs are flexible modes of investment that allow you to invest as per your financial needs and risk tolerance capacity — from equity funds to debt funds or hybrid funds that are a combination of both," Kotaklife stated.

Bank deposits

Bank deposits are risk-free avenues and can also help as a contingency fund. For fixed deposits, you may require a lump sum and that may not be possible when you are young. So, instead you can go for recurring deposits. These can help in accumulating a considerable sum if invested for a long-term.

How much you should invest?

When you are young, you can start with 5-10 percent allocation and gradually move to 20-30 percent within 5-6 months, experts suggest.

Note To Readers

The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM