The Income Tax (I-T) Department allows taxpayers to claim any excess payment of tax by filing an income tax return (ITR). Eligible taxpayers can check the status of tax refund online through the e-filing website — incometaxindiaefiling.gov.in or via the e-governance website of National Securities Depository Limited (NSDL) - tin.tin.nsdl.com.

Live TV

Loading...

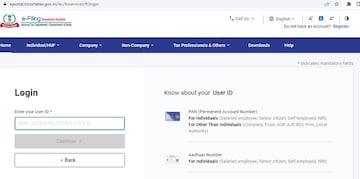

Here are the steps to check ITR refund status online via tax website:

Steps 1:

Log on to the account using your user ID (PAN) and password on the e-filing website

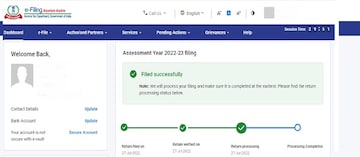

Steps 2: Select 'Income tax returns' and then click on 'View Filed returns'.

Step 3: Now, check the latest ITR filed

Step 4: Select the 'View Details' option and it will show the status of the ITR filed. One can navigate to the 'Status of Tax Refunds' tab. A message will pop up, giving the mode of payment, a reference number, status and date of refund.

In order to check income tax status through the website tin.tin.nsdl.com, users can enter their Permanent Account Number (PAN) and select the relevant assessment year. The status will be reflected.

'Refund paid' status is also reflected in the 'Tax Credit Statements' in Form 26AS.

Depending on the option exercised by the assessee while filing the annual ITR, the refund is made either through electronic mode i.e. direct credit to account or through a refund cheque.

What are the different types of ITR refund status?

Processed: This is the status when the return is successfully processed.

Submitted and pending for e-verification/verification: This is the status when the taxpayer has filed the ITR but not e-verified it, or the duly signed ITR-V has not been received at CPC yet.

Successfully e-verified/verified: This is the status when the taxpayer has submitted and duly e-verified/verified the return, but the return has not been processed yet.

Defective: This is the status where the department notices some defect in the filed return.

Expired: This status means that the refund has not been presented for payment within the validity period of 90 days. The taxpayer, in this case, may raise a refund re-issue request.

In case the return was filed electronically- the refund reissue request may be raised online by logging into the e-filing portal with the user ID and password.

The Income Tax (I-T) Department had allowed taxpayers to claim any excess tax payment for the financial year 2021-22 by filing an income tax return by July 31, 2021, without any penalty. Those who failed to do this can file a belated return now with a certain penalty.

(Edited by : Ajay Vaishnav)

First Published: Aug 10, 2022 2:18 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: All you need to know about EVMs and VVPAT; how they work

Apr 20, 2024 1:24 PM

Odisha Lok Sabha elections: Schedule, total seats, Congress candidates and more

Apr 20, 2024 11:39 AM

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM