ICICI Prudential Mutual Fund has announced the launch of ICICI Prudential Transportation and Logistics Fund, an open-ended equity scheme predominantly investing in equity and equity related securities of companies engaged in transportation and logistics theme. The new fund offer (NFO) will open for subscription on October 06, 2022 and close on October 20, 2022.

Live TV

Loading...

The fund will be managed by Harish Bihani and Sharmilla D’Mello (for Overseas Investments).

The scheme may invest in sectors/stocks that form a part of Nifty Transportation and Logistics TRI which is also the benchmark of the offering. The scheme may follow a buy and hold approach and hence an investment horizon of minimum five years is recommended, ICICI Prudential MF said.

Transportation and logistics theme is considered as an engine for economic growth. The theme consists of industries broadly classified under three key sectors which are Auto Original Equipment Manufacturers (OEMs), Auto Components (Ancillaries) and Logistics.

Auto sector today has emerged as a space which is no longer a luxury anymore. The Auto OEM sector with its presence across different products offers multiple investment opportunities including auto ancillaries. Given rising fuel prices and increased focus to reduce emissions, countries globally have adopted EVs in a significant manner. India is expected to follow suit thereby giving rise to multiple investment opportunities.

Speaking on the launch of the product, Chintan Haria, Head - Product Development and Strategy, ICICI Prudential AMC said, “Transportation is an under-penetrated market in India. The new policy on logistics by the government underlines the key role played by the sector in the economic growth of the country. Formalization of the economy and positive correlation to GDP growth and the Government's initiatives to reduce costs and improve efficiency, all stand to benefit the sector in the coming years. With muted performance in the last couple of years, we believe the theme is coming out of the woods and there are more legs to recovery.

"Coming to logistics, formalization of economy i.e. shift from unorganized to organized sector aids in the growth of logistics space. India’s logistics market is estimated at $ 216 billion out of which organized players contributed only ~3.5%($6-7 Billion) in FY 2020. We expect disruption in this segment and market share shift from unorganized to organized players as Indian e-commerce shipments growth plays out. Going forward, Government initiatives may lead to cost reduction and increase efficiency," he said.

Theme Performance

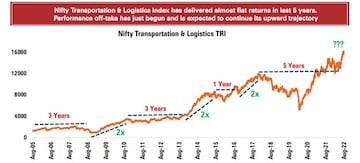

Nifty Transportation and Logistics Index performance offtake has just begun and is expected to continue its upward trajectory.

(Source - NSE. Data as of Aug 31, 2022. Past performance may or may not sustain in future)

(Edited by : Anshul)

First Published: Sept 29, 2022 5:35 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Exclusive: FM Nirmala Sitharaman says poverty alleviation can't be achieved by throwing money at the problem

Apr 18, 2024 7:27 PM

Tamil Nadu Lok Sabha elections 2024: List of Congress candidates

Apr 18, 2024 4:33 PM

Will the payment under PM-KISAN be increased? Here's what Finance Minister said

Apr 18, 2024 3:58 PM