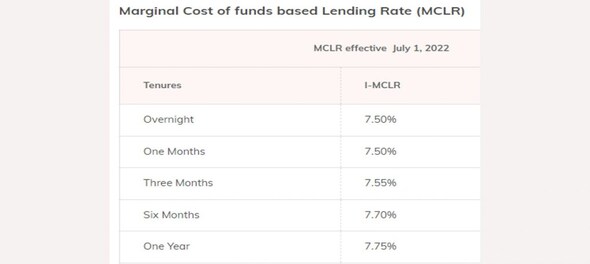

ICICI Bank increased its marginal cost of lending rate (MCLR) by 20 basis points (bps) across all tenures. Earlier on June 1, the private lender had raised the MCLR rate by 30 bps.

Live TV

Loading...

According to the ICICI website, the overnight and one-month MCLR has been increased to 7.50 percent from 7.30 percent last month. The three-month and six-month MCLRs at ICICI Bank also rose to 7.55 percent and 7.70 percent respectively. One year MCLR spiked to 7.75 percent.

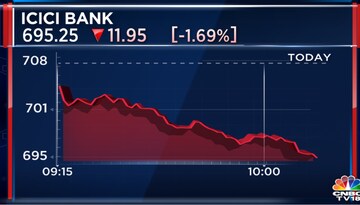

Around 10 am on Friday, the ICICI shares were down by 1.69 percent at 695.27. Around 1:05 pm, the company's shares gained but were still plunged by 0.61 percent at 702.55.

Recently, the State Bank of India (SBI), HDFC Bank and ICICI Bank acquired a 9.54 percent stake each in Perfios Account Aggregation Services Private Limited (Perfios AA). These banks acquired 8,05,520 equity shares each by paying Rs 4.03 crore each for the stakes.

This last week, on International MSME Day, ICICI Lombard General Insurance Company said it will settle the MSME clients' admissible claims of up to Rs 5 lakh within 10 days of completing the claims survey. The claims settlement process was the first-of-its-kind service to enable faster claim settlement for MSMEs and startups, ICICI Lombard said in a release.

Earlier, the Fed's steepest rate hike in almost three decades has sent the Nifty Bank — which tracks the performance of SBI, ICICI Bank, HDFC Bank ICICI Bank, Bank of Baroda and seven other major lenders — tumbling into the bear zone.

(Edited by : Akriti Anand)

First Published: Jul 1, 2022 4:34 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP MP's wife challenges him in electoral battle for Etawah seat

Apr 25, 2024 9:39 AM

Lok Sabha Election 2024: Gurugram gears up for crucial polls amidst economic boom and civic woes

Apr 24, 2024 11:41 PM

Lok Sabha Election 2024: Crucial seats up for grabs as Rajasthan, Maharashtra, Bihar gear up for 2nd phase of polls

Apr 24, 2024 11:40 PM

View | A small inheritance tax is not a bad idea

Apr 24, 2024 10:04 PM