With Friday's repo rate hike and two previous increases, the overall lending rates have surged by at least 190 basis points, or 1.9 percent. In this high interest rate regime, it is natural for home loan borrowers to get worried. At this point, experts are suggesting that existing borrowers explore the possibility of interest cost savings through home loan balance transfer.

Live TV

Loading...

Also known as refinancing, this is a process of transferring outstanding loan balances to a new lender.

So, how is home loan transfer or refinancing done?

Customers can get a new lender to settle the dues with the existing lender and take over the outstanding loan amount. After deciding on a lender, customers can complete the documentation and pay off the loan to the old lender and takeover the outstanding loan amount.

After this, EMIs should be paid to the new lender.

Who should go for home loan transfer?

Existing home loan borrowers who have witnessed substantial improvements in their credit profile availing of their home loan should explore the possibility of interest cost savings through home loan balance transfer. Their improved credit profile may make them eligible for home loans at much lower rates from other lenders, said Naveen Kukreja — CEO and Co-Founder, Paisabazaar.

Lower interest rates translate to lower Equated Monthly Instalments (EMIs). This means more money in hands at the end of the month.

With floating interest rates offered by most banks, which are linked to the repo rate set by RBI, experts say that customers should find home loans with interest rates lower than what they are paying now from another bank of NBFC.

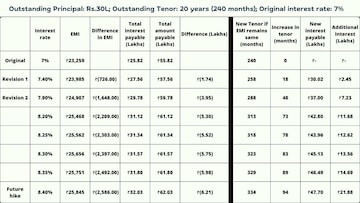

Here's a table showing increasing EMIs on Rs 30 lakh home loan (with different increased rates scenario):

(Source: Bankbazaar)

What are factors to consider before going for home loan transfer?

Consider associated expenses

While considering a loan transfer, it is essential to take into account the expenses associated with it. Home loan balance transfers usually attract a processing fee of 1 percent, payable to the new bank. This is important to note as this may overshadow the savings the borrower may incur if they transferred the loan, depending on the loan amount, Adhil Shetty, CEO of Bankbazaar, cautioned.

In addition, there can be legal charges, valuation fees, stamp duty, and other charges associated with the loan. Typically, all the costs associated with a new loan are applicable to the refinance as well.

"Hence, it’s better to calculate the exact change in outflows before borrowers refinance their loans. As a thumb rule, the difference should at least be a minimum of 0.5 percent from the existing rate for good savings post-processing fees and other charges," Shetty said.

Negotiate well

Shetty said that borrowers should negotiate with their lenders for better rates before opting for refinancing as this could prove less expensive and more convenient.

Here are the latest rates offered by banks on home loans:

| Banks | Starting Interest Rate (p.a.) |

| State Bank of India | 7.55% |

| Citibank | 6.65% |

| Union Bank of India | 7.40% |

| Bank of Baroda | 7.45% |

| Central Bank of India | 7.20% |

| Bank of India | 7.30% |

| Axis Bank | 7.60% |

| Canara Bank | 7.60% |

First Published: Aug 10, 2022 5:52 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: From Wayanad to Shivamogga, key battles in the second phase

Apr 25, 2024 2:01 PM

EC probes allegations of MCC violation by Modi, Rahul; seeks response by April 29

Apr 25, 2024 1:32 PM

LS polls phase 2: Rahul Gandhi, Shashi Tharoor in fray; Hema Malini, Om Birla eyeing hat-trick

Apr 25, 2024 12:19 PM

UP constituencies to witness three-cornered fight in second phase tomorrow

Apr 25, 2024 10:47 AM