HDFC Bank in its post-earnings call for the September quarter said that it expects to complete its merger with HDFC Ltd. a few months ahead of the stipulated timeline. The merger of the parent firm with its subsidiary bank is, however, scheduled to be concluded by mid-2023.

Live TV

Loading...

The merger proposal of the two entities has already got most of the approvals, barring the shareholders’ nod (scheduled on November 25) along with the final clearance from the Reserve Bank of India (RBI).

So, as things move ahead, it makes sense to understand how the merger will impact the mutual fund portfolios.

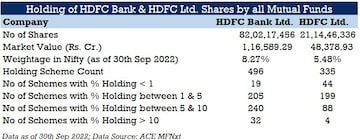

A look at mutual fund portfolios of HDFC Bank and HDFC

As of September 30, 2022, mutual fund schemes collectively held Rs.1.65 lakh crore worth of HDFC Bank and HDFC Ltd. shares under various portfolios. The holding count schemes stood at 496 for HDFC Bank and 335 for HDFC Ltd.

The combined weightage of both these entities was 13.75 percent.

According to Gopal Kavalireddi, Head of Research at FYERS, the swap ratio will be 42 shares of HDFC Bank for every 25 shares of HDFC Ltd held.

"Post the merger, HDFC Bank will continue to operate as a single entity," he said.

The current norms

As per the norms specified by the capital markets regulator, Sebi, for diversified equity funds, the investment in equity shares or equity-related securities of a single company must not exceed 10 percent of the net assets of the scheme.

This regulation does not apply to sector-specific or thematic funds.

The impact on mutual funds

As per the last available data, the number of schemes across all AMCs holding HDFC Bank greater than 10 percent in their portfolios was 32 schemes, and for HDFC Ltd, only 4 schemes.

So, upon completion of the HDFC Bank -HDFC merger, a single entity would remain, and mutual fund managers of diversified equity schemes are expected to make the necessary adjustments to their respective portfolios, bringing down the maximum holding percentage equal to or less than 10 percent, said Kavalireddi while talking to CNBC-TV18.com.

As a result, mutual funds may rejig their portfolios.

The impact on NSE

Analysts are expecting heavy fluctuations in the Nifty on the possible fund outflows on the merger of the HDFC twins which together command over 13 percent of the Nifty now.

Given this huge weight of the HDFC twins in the benchmark index, NSE has issued a consultation note on the possible outcomes of the merger on the index and the resultant exclusion of HDFC and inclusion of a replacement stock.

What should investors do?

As per Kavalireddi, investors need not be excessively worried about any possible sell-off, as the adjustments due to the merger can be easily absorbed by other schemes.

(Edited by : Abhishek Jha)

First Published: Oct 31, 2022 5:06 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM