Gold prices are drawing support from fears of a slowdown at a time when major central banks are lining up their biggest hikes in key interest rates from the COVID-era lows. But it may not revisit their all-time highs — of August 2020 — anytime soon. That is the view coming in from experts.

Live TV

Loading...

The yellow metal — typically boosted by periods or mere fears of financial uncertainty — has lost more than Rs 4,000 per 10 grams or eight percent of its value from all-time highs from the depths of the pandemic.

Concerns about new waves of the pandemic and the Ukraine crisis have though aided a recovery in gold, analysts see the precious metal as an attractive investment bet from a three-year perspective.

They fear the near-term outlook of gold is not as promising, despite an improvement in its safe-haven appeal, when the and the dollar index — which gauges the greenback against six peers — is not far from two-decade peaks.

"Gold recently attempted to get past the $1,880 per ounce levels amid fears about a recession but faced headwinds owing to the hawkish rhetoric of the Fed and the rival-dollar index holding firm... Gold may remain in a consolidation phase in the near term but the longer term picture is certainly positive as long as it holds the Rs 48,800 per 10 grams or $1,720 per ounce level on a closing basis," Sugandha Sachdeva, VP-Commodity and Currency Research at Religare Broking, told CNBCTV18.com.

She said the short-term outlook for gold is shaky given the tightening of global financial conditions though the looming recession risk is aiding its price, she said.

Gold cannot reach the Rs 60,000 mark in the current situation, Manoj Kumar Jain, Head-Commodity and Currency Research at Prithvi Finmart. He sees the yellow metal correcting to the Rs 50,000 mark in the worst case scenario and Rs 53,000 in the best.

This is in stark contrast to equities, which continue to be in correction territory and have even flirted with the bear zone. A stock or index is said to be in correction when it retreats more than 10 percent from its peak and in the bear area in case it falls more than 20 percent.

Gold shares an inverse relationship with riskier asset classes such as equities. Indian equity benchmark Nifty50 has retreated about 15 percent from a record high in October 2021, which came at the end of a near one-sided liquidity-driven record run that lasted 18 odd months.

The bulls on Dalal Street have since struggled against a consistent withdrawal of money from Indian shares by foreign institutional investors.

But there's a silver lining for the more patient yellow metal faithfuls. Jain believes the current bout of weakness in gold rates to reverse from October 2022.

"Normally, gold is treated as a hedge against inflation and against bad times but this time, the story looks different. In the next one quarter or so, it could test $1,750-1,720 per troy ounce levels — or Rs 50,500-50,000," he said.

Jain expects gold to test $1,950 per ounce or Rs 53,000 per 10 grams by the end of 2022.

What should investors do?

Jain is of the view gold should make a new high in 2023, an opportunity long-term investors can tap by using every dip to take positions in the precious metal through a systematic investment plan (SIP) route.

That means gold may cross the Rs 56,191 per 10 grams — or $2,063.2 in the global benchmark — the next year itself, followed by even higher levels.

How much can gold rise post-2023?

After the current phase of correction and consolidation, fears of recession along with the inflation narrative are expected to boost gold's safe-haven appeal to take it to levels around Rs 60,000, according to Sachdeva.

"Factoring in a substantial deterioration in economic activity, the Fed might pause its tightening cycle and even turn a bit dovish, which can exert pressure on the greenback and lead to lower rates across the US treasury yield curve. Such a scenario will probably favour flows in gold, leading to a strong rebound in prices," she said.

Some are even banking on silver in view of healthy industrial demand.

Ajay Kedia, Managing Director at Kedia Advisory, believes silver is in for a period of appreciation after taking a breather in the past few months.

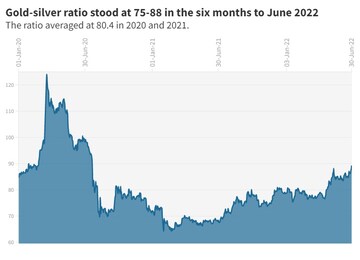

Kedia finds silver more attractive given the gold-silver ratio of more than 90:1.

"There is pessimism in the market... Gold will be at an advantage for the next 2-3 years as investors' purchasing power improves after the impact of concerns about a recession," Kedia told CNBCTV18.com.

The gold-silver ratio indicates the relation between gold and silver prices. Simply put, it shows the number of times an ounce of gold costs in comparison to an equal quantity of the white metal.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Polls '24 | Will Katchatheevu resurgence in the campaign help BJP in Tamil Nadu

Apr 19, 2024 10:00 AM

Lok Sabha Elections 2024: DMK’s A Raja eyes second term in Nilgiris in a four-cornered contest

Apr 19, 2024 7:58 AM