Gold prices are trading higher on Tuesday, extending this year's gains to an all-time high. On Multi Commodity Exchange (MCX), gold surged to Rs 57,099 per 10 grams, up nearly four percent so far in 2023. Globally, spot gold rose 0.2 percent to $1,935.69 per ounce as of 0208 GMT.

Live TV

Loading...

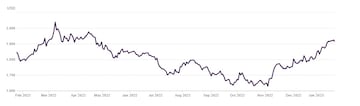

Gold prices have been increasing since the beginning of November 2022. In India, rates are up Rs 7,000 per 10 gram since November.

(A look at gold prices in the last one year. Source: WGC)

So, what's the trigger?

Weakness in US dollar

The rise in gold prices comes amid weakness in the US dollar and softening of US treasury yields. The dollar index dipped 0.2 percent, making greenback-priced bullion more affordable for many buyers.

Gold is usually denominated in US dollars and there is an inverse relationship between the two. This means that as the value of the US dollar rises, the value of gold falls. The strength of the US dollar is related to the factor of interest rates.

Global economic slowdown

Another factor which analysts are stressing on is global economic slowdown. Investors are seeking refuge in the safe haven metal amid concerns over a global economic slowdown.

According to a note shared by Kotak Securities, deteriorating outlook for global economy, particularly US and the prospects of a Fed pivot have brought in some inflows.

"India’s gold imports in 2022 dropped to 706 tonnes from 1,068 tonnes a year ago. Prospects of a looming slowdown in US, cooling inflation and labour market coupled with a Fed pivot might continue to bolster the gold prices," it said.

Rising bets for lower rate hikes

US Fed is expected to raise rates by 25 basis points in its upcoming policy meeting. This means a slower pace after four consecutive 75 bps increases. Lower interest rates are beneficial for bullion, decreasing the opportunity cost of holding the non-yielding asset, experts say.

A look at the investment strategy

According to experts, short to mid-term investment in gold is always fine. Like any other asset class, it is difficult and futile to time the market, whether it is gold or equity. So, the thumb rule for gold is to allocate up to 10 percent of savings/portfolio in gold-related instruments and stay invested to get the benefit of appreciation in gold prices which have a tendency to catch up with inflation.

On top of that, diversification is important due to the uncertain economic environment and volatility in the stock market. However, the rule of investment says that asset class should not be looked at as a primary investment vehicle. Rather it should be used for portfolio diversification purposes.

ALSO READ | PPF investment for tax saving — Interest rate, maturity, premature withdrawal and key details

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Tamil Nadu Lok Sabha elections 2024: Full list of BJP candidates

Apr 18, 2024 2:37 PM

Tamil Nadu Lok Sabha elections 2024: Seats, schedule, DMK candidates and more

Apr 18, 2024 1:34 PM

Narayan Rane is BJP's candidate from Ratnagiri Sindhudurg Lok Sabha seat

Apr 18, 2024 11:44 AM