Gold is currently available at considerably low prices — with an almost two-year dip in rates. On MCX India, gold futures were trading at Rs 50,280 on Tuesday (November 1) morning. In terms of demand, however, an upward trajectory can be seen. It went up by 14 percent in the July-September quarter, which also included the month from Navratri to Dhanteras, according to the World Gold Council (WGC).

Live TV

Loading...

A look at recent gold prices

Gold prices saw a nominal decline of Rs 160 in Tuesday's early morning trade in India. On November 1, 24 carat gold was trading at Rs 50,840 per 10 gram compared to Rs 51,000 on October 31.

In the US, gold prices were flat in early morning trade, after touching their lowest levels in more than one week. Gold prices have declined about 21 percent since rising past the $2,000 per ounce level in March.

Gold demand

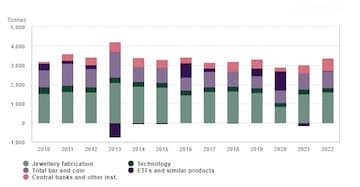

Gold demand (excluding OTC) in Q3 was 28 percent higher YoY at 1,181t. Year-to-date (YTD) demand increased 18 percent versus the same period in 2021, returning to pre-pandemic levels, as per WGC.

Year-to-date gold demand resumes its pre-pandemic pace

(Source: WGC)

The way ahead

Considering another anticipated rate hike of 0.75 percent by the US Fed in the upcoming meeting this week, downward selling pressure is expected on the gold, said Nitin Thard, Director at SafeGold while talking to CNBC-TV18.com.

“Major support levels for gold are Rs 49,500 to Rs 49,750 (rate per 10 grams). US Fed’s pivot on the interest rate hike can take the gold prices in the upward direction, which seems to be unlikely in the current high inflationary environment,” Thard said.

The Federal Reserve is widely expected to raise its benchmark overnight interest rate by 75 basis points (bps) to a range of 3.75-4 percent, its fourth such increase in a row.

Recently, there has been a spate of rapid rate hikes from the Fed.

Higher US interest rates generally increase the opportunity cost of holding the non-yielding bullion.

However, when we talk specifically about gold, the relationship between its prices and interest rates is uncertain and unstable because gold is traded on a global market, which is subject to forces far beyond the reach of the Federal Reserve.

On the other hand, there is also renewed risk appetite in markets, and it will likely cause an important move higher in equities and growth-linked currencies and also gold, which has been moving in line with the broader risk sentiment, Daniela Hathorn, analyst at Capital.com was quoted as saying in a Reuters report.

Meanwhile, given the rising inflation, India’s gold demand is likely to fall in the months of October to December by around a quarter, compared to last year.

Globally, the strong dollar is drawing demand away from gold. It will be a while before gold rates begin to go up again, said Adhil Shetty, CEO at Bankbazaar.com

(Edited by : Shoma Bhattacharjee)

First Published: Nov 1, 2022 7:04 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Chhattisgarh Lok Sabha elections 2024: Bhupesh Baghel among the list of Congress candidates

Apr 19, 2024 3:45 PM

Chhattisgarh Lok Sabha elections 2024: Full list of BJP candidates

Apr 19, 2024 1:46 PM

Lok Sabha Election Phase One: WB records 51% voting, UP 37%, Maharashtra 32% till 1 pm

Apr 19, 2024 12:56 PM

Violence mars first phase of Lok Sabha polls in West Bengal

Apr 19, 2024 12:09 PM