Fixed deposit (FD) interest rates have crossed 9 percent-mark after many years, with several repo rate hikes by the Reserve Bank of India (RBI) in the last few months. Currently, some small finance banks are offering 9 percent and above interest rates while various private lenders are offering a rate of 7 to 8 percent. While these increased interest rates may augur well for FD investors, they might be in dilemma — if they should now book their FDs or wait further for more hikes?

Live TV

Loading...

CNBC-TV18.com spoke to experts and tried to answer this.

Repo rate hike and FD rates rise

Since May, the RBI has increased the repo rate by 225 basis points to 6.25 percent. The first hike was to the tune of 40 bps in May and then 50 basis points in June. It again raised the repo rate by 50 bps in August and then again by 50 bps in September. Considering another hike of 35 bps in December, the total rise comes to 225 bps.

Consequently, deposit rates have been increased by banks. A relatively risk-free instrument, fixed deposit (FD) generally become attractive in higher interest rate regimes. Deposit rates are linked to the rate of inflation. Banks generally give positive returns to depositors.

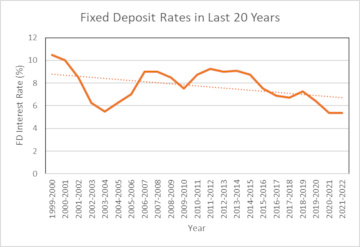

If we look into the history, fixed deposit rates in India have recorded higher levels during 1994-1999. During 2012-2013, it was 8.75-9 percent. The rates averaged 5.7-6.4 percent in 2019-2020 and stood between 5.25 percent and 5.35 percent in 2020-21. In 2018-19, rates were hovering between 6.25 percent and 7.25 percent, according to Bajaj Finserv.

During COVID-19 pandemic, central bank had reduced rates and as a result FD rates dropped to as low as 5.5 percent. This scenario has changed now.

Here's a look at last 10 years FD rates in India and a graph showing the change in last 20 years:

| Year | Average Fixed Deposit Interest Rate |

| 2012 - 2013 | 8.75 - 9.00% |

| 2013 - 2014 | 8.75 - 9.10% |

| 2014 - 2015 | 8.50 - 8.75% |

| 2015 - 2016 | 7.00 - 7.50% |

| 2016 - 2017 | 6.50 - 6.90% |

| 2017- 2018 | 6.25 - 6.70% |

| 2018 - 2019 | 6.25 - 7.25% |

| 2019 - 2020 | 5.70 - 6.40% |

| 2020 - 2021 | 5.25 - 5.35% |

| 2021 - 2022 | 5.50- 6.00% |

(Source: Bajaj Finserv)

(Source: Bajaj Finserv)

The current FD offerings

Here are the latest FD rates of key banks:

| Name of Bank | For General Citizens (p.a.) | For Senior Citizens (p.a) |

| State Bank of India | 3.00% to 6.75% | 3.50% to 7.25% |

| HDFC Bank | 3.00% to 7.00% | 3.50% to 7.75% |

| ICICI Bank | 3.00% to 7.00% | 3.50% to 7.50% |

| IDBI Bank | 3.00% to 6.25% | 3.50% to 7.00% |

| Kotak Mahindra Bank | 2.75% to 7.00% | 3.25% to 7.50% |

| RBL Bank | 3.25% to 7.55% | 3.75% to 8.05% |

| KVB Bank | 4.00% to 7.25% | 5.90% to 7.65% |

| Punjab National Bank | 3.50% to 7.25% | 4.00% to 7.75% |

| Canara Bank | 3.25% to 7.00% | 3.25% to 7.50% |

| Axis Bank | 3.50% to 7.00% | 3.50% to 7.75% |

| Bank of Baroda | 3.00% to 6.75% | 3.50% to 7.25% |

| IDFC First Bank | 3.50% to 7.50% | 4.00% to 8.00% |

Here are the latest rates offered by small finance banks

| Name of Bank | For General Citizens (p.a.) | For Senior Citizens (p.a.) |

| Suryoday Small Finance Bank | 4.00% to 8.51% | 4.50% to 8.76% |

| Ujjivan Small Finance Bank FD | 3.75% to 8.00% | 4.50% to 8.75% |

| ESAF Small Finance Bank | 4.00% to 8.00% | 4.50% to 8.50% |

| Unity Small Finance Bank | 4.50% to 8.50% | 4.50% to 9.00% |

| Jana Small Finance Bank | 3.75% to 7.85% | 4.70% to 8.80% |

| Utkarsh Small Finance Bank | 4.00% to 8.00% | 4.75% to 8.75% |

| Equitas Small Finance Bank | 3.50% to 8.00% | 4.00% to 8.50% |

| Fincare Small Finance Bank | 3.00% to 8.00% | 3.50% to 8.50% |

| AU Small Finance Bank | 3.75% to 7.75% | 4.25% to 8.25% |

| Capital Small Finance Bank | 3.50% to 7.50% | 4.15% to 8.15% |

| North East Small Finance Bank | 3.00% to 7.75% | 3.75% to 8.50% |

Will FD rates rise further?

There is some more possibility of upside in interest rates offered on bank FDs, experts say. This is because worldwide inflation has remained high for a number of reasons and accordingly, there is a strong likelihood of another interest rate increase.

ALSO READ | SIP inflows extend record levels, but cancellations at 25-month high is concerning: Experts

It's also anticipated that market liquidity would remain tight over the next few months. Therefore there is a strong possibility that the FD rates might increase even further in the months to come, experts opine.

However, the hike will not be a major one now as a major part of the interest hike in policy rate is done and most of it has already been delivered into the FD rates, analysts say.

So, investors book now or wait further?

Experts say that waiting further for more hikes would not be a decent move. Instead, laddering FDs would be better. Fixed deposit laddering is a process of spreading investment in FDs over multiple maturity tenures or maturity buckets, whereby investors hold the chance to earn a higher return and even address the liquidity needs.

Also, it must be remembered that the purpose of any investment should be to fulfil present and future needs. Most people consider bank fixed deposits to be risk-free investment. However, even if banks have increased the interest rates on fixed deposits, neither the pre-tax nor the post-tax returns are sufficient to keep up with the pace of inflation.

“Because of this, investors whose comfort level with risk is somewhere between moderate and high might not find bank fixed deposits to be the most suitable long-term investment product,” said Abhinav Angirish, Founder of Investonline.in.

Assuming that one does not fall in tax bracket, if the interest rate on a fixed deposit is 6.50 percent per year and inflation in India is around 7 percent per year, the inflation-adjusted return one will earn is -0.47 percent per year.

So, experts say that fixed deposits are a good option only for investors with relatively low risk tolerance levels and who want to start saving for goals that are fewer than three years away.

(Edited by : C H Unnikrishnan)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM