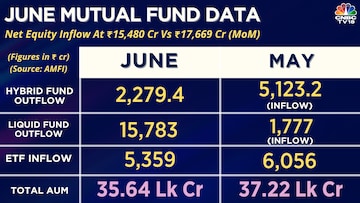

Amid volatility in the stock market, soaring inflation, and continued selling by foreign portfolio investors (FPIs), and equity mutual funds witnessed a 12.4 percent fall in net inflow to Rs 15,480 crore in June compared with the previous month. That makes June a 16th back-to-back month of inflow.

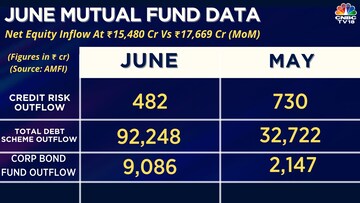

All mutual fund schemes – debt and equity – saw outflows in the month of June, dragged by liquid funds, ultra-short duration funds, corporate bond funds, and money market funds.

Liquid funds — which are used by companies to park short-term cash —witnessed outflows after two straight months of investment. Liquid fund outflow stood at Rs 15,783 crore in June as against Rs 1,777 crore inflow in the previous month.

Money market funds saw outflow of Rs 8,126.1 crore in June against an inflow of Rs 14,598.6 crore in May.

Investors withdrew from credit risk funds for the seventh straight month in June. Hybrid fund outflow stood at Rs 2,279.4 crore in June as against Rs 5,123.2 crore inflow witnessed in the previous month.

Arun Kumar, Head of Research, FundsIndia said that despite significant FII selling over the last several months, the market impact has been reasonably contained thanks to the strong domestic institutional investors (DII) flows.

"Usually, whenever markets are volatile and the recent one year returns become weak as it’s happening now, DII flows tend to weaken. Bucking the trend, equity mutual funds continue to receive strong inflows for June-20. While this is positive for the markets, we need to keep a close watch on the Equity MF inflows and SIP trend in the coming months as they are critical given the backdrop of strong FII outflows," said Kumar.

Of all the categories, while multi caps saw the least investments, large caps saw the highest.

The average assets under management (AUM) stood at Rs 36.98 lakh crore versus Rs 37.3 lakh crore in May. Net AUM, too, fell to Rs 35.64 lakh crore from Rs 37.2 lakh crore in the previous month.

First Published: Jul 8, 2022 11:49 AM IST