Balanced advantage funds, also known as dynamic asset allocation funds, are from the category of hybrid mutual fund schemes. They invest in the asset classes like equity and debt and they keep modifying these asset allocations based on market valuations.

It fits well at a time of high market volatility where you could rely on a fund manager to alter the equity and debt split depending on shifting market conditions.

In fact in 2021, the assets under management came in at over Rs 71,000 crore, which is the highest growth among all equity and hybrid funds.

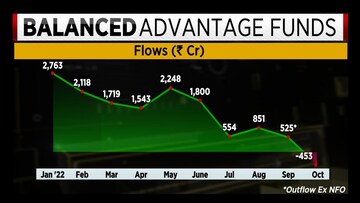

However, for several months, the net inflows into balanced advantage funds have been coming down. In fact for the past two months, ex of the new fund offer, we have seen an outflow in this category. The outflow for the month of October was around Rs 450 crore.

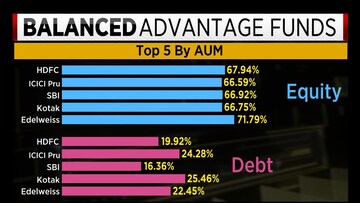

The equity to debt split in some of top 5 balanced advantage funds by AUM and the split like is around 67-71 percent in equity and between 16-24 percent in debt. This is for the top 5 funds by size.

CNBC-TV18 spoke to Prableen Bajpai, Founder of FinFix Research & Analytics to help analyse all this data and also take through the case for investing in this category.

On inflows coming down, Bajpai said, “With markets improving, investors' confidence has begun to rise. So, we don't really need to sit in the balanced advantage category and we can participate in the markets on our own. I think that is the reason why there is some bit of exit.”

She added, “I think the guard is down from an investor's point of view and the category has not been able to deliver returns, because theoretically it can but it still needs some time for it to perform. So ,I think there is some bit of disappointment and a little rise of the confidence at the investor level.”

Watch the video for more.