Union Finance Minister Nirmala Sitharaman, in her Budget 2023 announcement, said that the standard deduction for salaried employees will now be a part of 'new tax slab'. Each salaried person with an income of Rs 15.5 lakh or more will stand to benefit by Rs 52,500 as standard deduction, FM said.

Live TV

Loading...

This is intended to help reduce the tax burden on salaried employees.

What is the role of standard deduction?

The standard deduction is usually deducted from the gross salary and claimed as an exemption. This deduction can be claimed by all salaried employees. This happens by default without any investment or spending of money by the taxpayers.

Standard deduction in old slab

Under the old tax slab, Rs 50,000 standard deduction is given. The same has been untouched in Budget 2023.

This limit was last revised in the 2019-20 financial year. The interim budget presented on February 1, 2019 included numerous tax benefits for the salaried and the middle class. Among those was an additional amount of Rs 10,000 (increased from Rs 40,000) to the standard deduction limit. No change was made in Budget 2020 and 2021.

The new proposal

Standard deduction has now become a part of new tax slab. Also, for those who earn Rs 15.5 lakh or more gets an extended limit.

Experts have been long demanding that standard deduction for salaried employees should be increased to reduce the employees' tax burden under section 16 of Income Tax Act.

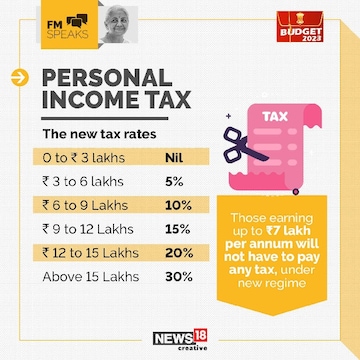

Meawhile, Sitharaman tweaked the Income Tax slabs to provide some relief to the middle class by extending tax rebate up to Rs 7 lakh under the new tax regime. The basic exemption limit has been raised to Rs 3 lakh from Rs 2.5 lakh.

It's important to note here that Budget 2020 introduced new tax regime. Under this, the taxpayers have an option to pay concessional tax rates. However major deductions and exemptions are not allowed under this new regime.

As per the revision, an individual with an annual income up to Rs 3 lakh will not have to pay any tax (as against an earlier limit of Rs 2.5 lakh). Further, it has proposed a 5 percent tax for income between Rs 3 – 6 lakh, 10 percent for income between Rs 6-9 lakh, 15 percent for income between Rs 9-12 lakh, 20 percent for income between Rs 12 – 15 lakh and 30 percent above Rs 15 lakh.

ALSO READ | Budget 2023 | Tax rebate limit raised to Rs 7 lakh under new regime — Check proposed tax slabs here

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM