Ahead of Union Budget 2023, Sudhir Kapadia - Partner, EY India Tax & Regulatory Services and Himanshu Parekh, Partner and Head of Tax (West) at KPMG discussed their income tax expectations. Citizens are awaiting the announcements related to income tax slabs as personal income tax slabs and rates have remained unchanged since 2017-18. The only change that was introduced in February 2020 was the ‘Simplified Tax Regime’ that provided an alternative of reduced tax rates at the cost of foregoing some deductions and exemptions.

Live TV

Loading...

While talking to CNBC-TV18, Kapadia said that most of the reforms are in place when it comes to corporate tax and Budget 2023 is an opportunity for the government to bring reforms in the personal income tax space. He said that he is expecting the government to make tweaks to the income tax.

"Highest income tax rate should kick in from Rs 20 lakh limit versus Rs 10 lakh currently," he told CNBC-TV18.

Currently, individuals have the choice of paying tax under the new slab with lower rates but foregoing deductions or continue paying tax under the existing tax laws and claiming the applicable exemptions.

ALSO READ | Budget 2023 EPF expectations — Experts want FM to reduce double taxation, raise Section 80C limit

Parekh of KPMG thinks that the government should revamp the new income tax regime. He said that out of 7 crore income tax return filers, less than 5 lakh tax savers have opted for the new regime.

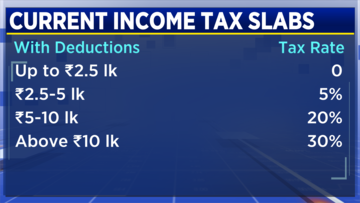

Currently, 7 income slabs are available under the new tax regime. According to it, annual income up to Rs 2.5 lakh is exempt from tax. Those individuals earning between Rs 2.5 lakh and Rs 5 lakh have to pay 5 percent tax. Income between Rs 5 and 7.5 lakh is taxed at 10 percent, while those between Rs 7.5 and 10 lakh at 15 percent.

Those earning between Rs 10 and 12.5 lakh have to pay tax at the rate of 20 percent, while those between Rs 12.5 and Rs 15 lakh have to pay at the rate of 25 percent. Income above Rs 15 lakh is taxed at 30 percent.

Here’s a comparison between both the regimes:

| Tax slab rates without exemption | Tax slab rates with exemption | ||

|---|---|---|---|

| Income from Rs 2.5 lakh to Rs 5 lakh | 5% | Income from Rs 2.5 lakh to Rs 5 lakh | 5% |

| Income from Rs 5 lakh to Rs 7.5 lakh | 10% | Income from Rs 5 lakh to Rs 10 lakh | 20% |

| Income from Rs 7.5 lakh to Rs 10 lakh | 15% | Income above Rs 10 lakh | 30% |

| Income from Rs 10 lakh to Rs 12.5 lakh | 20% | ||

| Income from Rs 12.5 lakh to Rs 15 lakh | 25% | ||

| Income above Rs 15 lakh | 30% | ||

Talking about deductions, Kapadia said that government should prune it and focus on investments, health and education.

Echoing the same views, Parekh said that it has been 8 years since standard deduction has been raised and there is a need to hike Section 80C deduction and lower interest on housing loans.

Currently, a deduction of Rs 50,000 as standard deduction is provided to each and every employee irrespective of their cost to company (CTC). On the other hand, Section 80C provides deductions on various investments up to Rs 1.5 lakh per year from one's taxable income. Experts thinks that government should look at increasing this limit to Rs 2.5 lakh, considering the increase in cost of living and inflation.

| Tax slab rates without exemption |

|---|

On capital gains, Kapadia said that it is normal for countries tp tax short-term capital gains at applicable marginal income tax rate. So, he don't think that government will tinker with it.

However, Parekh said capital gains tax should be revamped.

"There is no merit in making changes to listed securities tax regime. Income tax mediation has been successful in other parts of world and should be a focus in our Budget as well," he told CNBC-TV18.

First Published: Jan 31, 2023 12:40 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM