India’s smartphone shipments fell to 151.6 million units in 2022, declining by six percent compared with 2021, according to analyst firm Canalys. The market also suffered its first-ever drop in shipments in the fourth-quarter holiday period, falling by 27 percent to 32.4 million.

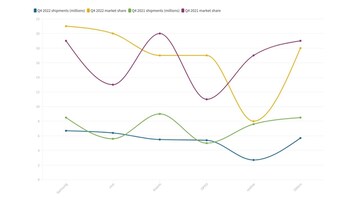

Samsung took the number one spot from October to December (Q4) 2022 for the first time since July-September 2017, shipping 6.7 million units for a market share of 21 percent. Second place went to vivo, which shipped 6.4 million units, mainly via offline channels. After 20 quarters, Xiaomi lost its leadership position in Q4 2022 and fell to third place with shipments of 5.5 million units. For all of 2022, Xiaomi was still the number one vendor. OPPO and realme remained in fourth and fifth place, with shipments of 5.4 million and 2.7 million units respectively.

(Source: Canalys)

(Source: Canalys)“India was better positioned to weather the global downturn than other markets. But domestic consumer spending cooled in the last few months of 2022,” said Sanyam Chaurasia, an Analyst at Canalys.

Chaurasia also believes that the decline in shipments could also be because in 2022, consumers already had up-to-date technology that they had bought during the pandemic, thereby delaying further purchases. This led to smartphone brands struggling with inventory management because demand was subdued. Vendor channel management strategies became more important than ever. The mid-to-high-end segment performed well this year, which will further catalyze the upgrade cycle,” he added.

According to Chaurasia, vendors that were focused predominantly on online channels suffered from poor e-commerce festive sales performance in Q4 2022. Xiaomi, for instance, aimed to clear out the inventory of its older models using the e-commerce channel. But, due to poor e-commerce festive sales, Xiaomi and realme saw significant stockpiling of their products in online channels in Q4 2022.

“At the same time, in tier-three and tier-four cities, vivo and OPPO focused on offline channels, which helped them to be the only vendors to grow year on year. With strength in the retail channel to drive volume, Samsung continues to target consumers across routes to market,” he said.

The global smartphone market also saw a decline in Q4 2022 as shipments fell 17 percent year on year. Full-year 2022 shipments declined by 11 percent to fewer than 1.2 billion, reflecting an extremely challenging year for all vendors. Apple reclaimed the top spot in Q4 and achieved its highest quarterly market share ever at 25 percent, despite facing shrinking demand and manufacturing issues in Zhengzhou.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM