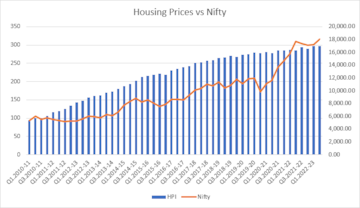

Real estate is not an asset class that many equity investors sing paeans about. It has inherent disadvantages versus liquid assets like stocks and bonds that can be easily and quickly encashed if required. But this also makes real estate a less volatile asset class. And in today’s uncertain global environment, this may not be such a bad thing. The standard deviations of Nifty and the RBI Housing Price Index clearly reveal that stocks are the clearly the more volatile asset class.

THE MYTH OF RETURNS

It has been argued that stocks are the best performing asset class over the long-term. That statement is not amiss, but if you study the returns from equity investing in India, using the Nifty as a proxy and compare that with returns as reflected by RBI’s all India housing price index (HPI), the return differential is not that significant. In fact, there are periods when one significantly outperforms the other.

A study of the returns by the two indices since 2010 reveals that Nifty has returned 236 percent since then, while housing prices are up 216 percent. What’s more, during the 2010 to 2015 period, while realty returned a CAGR of 17.6 percent, the return on Nifty was just 8.8 percent. The variance in returns over periods offers an opportunity to investors to maximise returns via making changes to their asset localisation between various asset classes.

REALTY CYCLES AND RETURNS

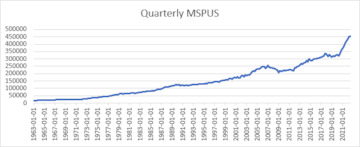

We’ve all heard experts talking about long equity cycles, and some of us recall these from our own experiences, but there’s nothing better than hard data to get a fix. We studied the trend in house prices in the US and found that bottom to peak cycles there have been typically 5 to 7 years long.

REALTY CYCLES IN THE US | ||

| Date (MMYY) | Median House Price (US) | Bottom to Top |

Oct-01 | 171100 | |

Jan-07 | 245400 | 5 years 3 months |

| Change % | 43.4 | |

Oct-10 | 221100 | |

Jan-18 | 331800 | 7 years 3 months |

| Change % | 50.1 | |

Jan-19 | 313000 | |

Jul-22 | 454900 | 4 years, 7 months |

| Change % | 45.3 | |

In India, too the realty cycle is fairly stretched. After the 2010 to 2015 run, in which realty prices jumped 125 percent, the returns have been modest to say the least—just 40% till 2022 or a CAGR of under 5%.

Could 2023 be the year of realty? There are significant indications on the ground and commentary from developers suggesting a strong possibility of this being the case. If so, realty could well be set for outperformance in 2023.

A DEFENSIVE BET

At a time of global uncertainties when money moves swiftly in and out of various liquid markets across the world, real estate is a local, less volatile investment avenue that draws more patient capital. What’s more, realty performance is very micro-market driven, and if you can identify the right locality or project to invest in, you can generate returns far ahead of the benchmark. To give you a sense, while housing prices for all of India are up 216% since 2010, there is significant variance in returns across cities, as indicated by the disaggregated index data.

Lucknow, Kolkata and Kochi top the list on returns, while Jaipur and Kanpur have been the worst performers. The much talked about Mumbai market has delivered lower returns than other big metropolises, Delhi and Bangalore. In fact, Ahmedabad has emerged as a strong performer.

City | HPI Chg 2010-2023 (%) |

MUMBAI | 218 |

DELHI | 222 |

BANGALORE | 229 |

AHMEDABAD | 238 |

LUCKNOW | 363 |

KOLKATA | 288 |

CHENNAI | 166 |

JAIPUR | 82 |

KANPUR | 91 |

KOCHI | 269 |

ALL INDIA | 216 |

A NEED FOR APPETITE

Realty, though, is not everyone’s cup of tea. To invest in the asset class, you need a significantly larger pool of capital and you have to be able to contend with illiquidity for a significant period of time.

But if you have the appetite and the time and inclination to scout for the most promising opportunities in the market, realty could well be your ticket to outperformance in 2023.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM