Jefferies reduced the weightage of IT stocks in its India model portfolio by three percentage points to 11 percent on Tuesday, saying the sector remains at a significant risk of a sell-off in case of a correction in the benchmark Nifty50. The brokerage is 'underweight' on the IT space.

It moved that weight to consumer staples, as it expects the space to be defensive in the event of a market correction.

IT stocks account for 11 percent weightage in the model portfolio, as against 14 percent in the Nifty. These are: Infosys (7.5 percent), Tech Mahindra (one percent) and TCS (2.5 percent).

Consumer staples have a larger weight of 13.2 percent in the portfolio, as against 10.8 percent in the benchmark index. These are: Hindustan Unilever (4.1 percent), Godrej Consumer Products (3.9 percent) and ITC (5.2 percent).

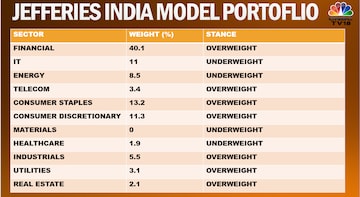

Here's a look at the brokerage's model portfolio:

The Nifty50 has had three declines of more than 10 percent each, where auto, industrials and FMCG have outperformed among the large sectors, and IT, healthcare and materials have underperformed, according to Jefferies.

"Banks have been broadly market performers. Any potential market correction will likely emanate out of hawkish stance by the Fed and the likely stagflation worries. That could hit the IT sector," the brokerage added.

Here's a look the 24 stocks that are a part of the portfolio:

| Stock | Weightage (%) |

| ICICI Bank | 12.2 |

| SBI | 6.5 |

| IndusInd | 2.3 |

| ICICI Prudential Life | 1.5 |

| LIC Housing Finance | 3.1 |

| Infosys | 7.5 |

| Tech Mahindra | 1 |

| TCS | 2.5 |

| Reliance Industries | 8.5 |

| Bharti Airtel | 3.4 |

| HUL | 4.1 |

| Godrej Consumer | 3.9 |

| ITC | 5.2 |

| Maruti Suzuki | 3.2 |

| Tata Motors | 1.2 |

| TVS Motors | 3.1 |

| Zomato | 2 |

| Indian Hotels | 1.7 |

| Max Healthcare | 1.9 |

| L&T | 1.8 |

| Concor | 1.6 |

| Thermax | 2.1 |

| PowerGrid | 3.1 |

| Lodha | 2.1 |

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

(Edited by : Nishtha Pandey)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Elections 2024: DMK’s A Raja eyes second term in Nilgiris in a four-cornered contest

Apr 19, 2024 7:58 AM

Coimbatore Lok Sabha election: TN BJP chief K Annamalai seeks maiden term in Parliament

Apr 19, 2024 7:42 AM

Inner Manipur Lok Sabha election: BJP and Congress face off in a bid for peace amid ethnic tensions

Apr 19, 2024 7:31 AM

Lok Sabha elections 2024: Assam's Jorhat to go to polls today

Apr 19, 2024 7:23 AM