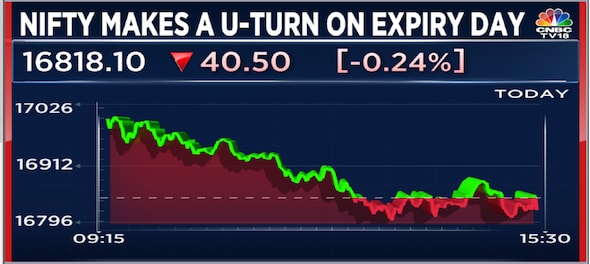

Indian equity benchmarks gave up initial gains in a volatile session on Thursday, as fag-end selling pressure in financial stocks sent the market tumbling into the red. The Nifty50 ended the September F&O series four percent lower — its worst performance in a monthly series since May.

All eyes are now the outcome of a three-day meeting of the RBI's rate-setting panel that ends on Friday. Economists in a CNBC-TV18 poll expect the central bank to announce a 50-basis-point hike in the repo rate on September 30.

What do the charts suggest for Dalal Street?

The Nifty50 has formed a long bear candle at the edge of important support at 16,800 on the daily chart, according to Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

"The market has been repeatedly testing support at 16,800 levels but not gaining momentum on the upside. This is not a good sign, and reflects that the support could be breached on the downside soon," he said.

Banking pack remains weak

"A breach of immediate resistance for the Nifty Bank at at 36,400 will lead to some short covering towards 39,000," said Kunal Shah, Senior Technical Analyst at LKP Securities.

"A fall below lower-end support at 37,500 will aggravate the sell-off towards 37,000-36,000 levels," he said.

Here are key things to know about the market ahead of the September 30 session:

SGX Nifty

On Friday, Singapore Exchange (SGX) Nifty futures — an early indicator of the Nifty index — fell as much as 89 points or 0.5 percent to 16,723 ahead of the opening bell on Dalal Street.

Global markets

Equities in other Asian markets began the day in the red, following overnight losses on Wall Street after a day's breather amid concerns that the Fed's steep rate hikes to fight inflation could hurt the US economy. MSCI's broadest index of Asia Pacific shares outside Japan was down half a percent at the last count.

Japan's Nikkei 225 was down 1.7 percent, China's Shanghai Composite 0.6 percent and Hong Kong's Hang Seng 0.8 percent.

S&P 500 futures edged 0.1 percent lower. On Thursday, the S&P 500 fell 2.1 percent, the Dow Jones 1.5 percent and the tech stocks-heavy Nasdaq Composite 2.8 percent, as investors fretted about a rout in global currency and debt markets.

What to expect on Dalal Street?

HDFC Securities' Shetti is of the view that a slide below 16,800 could take the 50-scrip benchmark all the way to its next key support at around 16,650.

"Any upside movement from here could encounter strong resistance around 17,030 levels," he said.

Key moving averages

The Nifty50 remains about four percent below its long-term simple moving average in a bearish sign.

| No. of sessions | Nifty50 | Nifty Bank |

| 5 | 16,844.1 | 37,690.4 |

| 10 | 16,877.5 | 37,794 |

| 20 | 16,931.6 | 38,023.2 |

| 50 | 17,180.4 | 39,012.8 |

| 100 | 17,500.1 | 40,088.8 |

| 200 | 17,583.6 | 39,845.2 |

FII/DII activity

Foreign institutional investors (FIIs) remained net sellers of Indian shares for the seventh trading day in a row on Thursday, according to provisional exchange data.

ALSO READ: 'Chakravyuh' moment in Indian market

Call/put open interest

The maximum call open interest is accumulated at the strike price of 17,000, with 1.9 lakh contracts, and the next highest at 17,500, with 1.5 lakh contracts, according to exchange data. On the other hand, the maximum put open interest is placed at 16,800, with 1.6 lakh contracts, and at 16,500, with 93,000.

This suggests a tough hurdle at 17,000 and support after a strong base at 16,800 only at 16,500.

Long build-up

Here are five stocks that saw an increase in open interest as well as price:

| Stock | Current OI | CMP | Price change | OI change |

| SBICARD | 1,152,800 | 907.2 | 1.10% | 65.51% |

| TORNTPHARM | 200,500 | 1,560.55 | 4.35% | 55.86% |

| PIIND | 304,250 | 2,981.30 | 0.48% | 55.22% |

| HINDUNILVR | 3,162,300 | 2,704.50 | 0.14% | 54.43% |

| APOLLOHOSP | 315,125 | 4,378.95 | 2.67% | 49.62% |

Long unwinding

| Stock | Current OI | CMP | Price change | OI change |

| HONAUT | 3,375 | 38,913.70 | -0.82% | -62.67% |

| INTELLECT | 462,000 | 514.85 | -3.98% | -59.74% |

| ASTRAL | 244,200 | 2,168.70 | -1.10% | -46.06% |

| DEEPAKNTR | 455,000 | 2,006.95 | -3.17% | -40.77% |

| BAJAJFINSV | 1,869,000 | 1,627.05 | -1.43% | -37.48% |

(Increase in price and decrease in open interest)

Short covering

| Stock | Current OI | CMP | Price change | OI change |

| FSL | 4,919,200 | 102.3 | 0.20% | -77.70% |

| EICHERMOT | 763,350 | 3,622.50 | 0.31% | -72.21% |

| RAMCOCEM | 493,850 | 750 | 1.46% | -65.40% |

| LTTS | 217,400 | 3,528.45 | 0.70% | -64.58% |

| ATUL | 32,250 | 9,002.20 | 2.35% | -57.91% |

(Increase in price and decrease in open interest)

Short build-up

| Stock | Current OI | CMP | Price change | OI change |

| MARUTI | 595,100 | 8,608.50 | -1.18% | 64.01% |

| MOTHERSON | 16,726,500 | 106.35 | -0.33% | 53.89% |

| GRASIM | 1,072,550 | 1,662.75 | -0.27% | 52.26% |

| TITAN | 1,224,750 | 2,529 | -1.94% | 39.87% |

| KOTAKBANK | 5,651,600 | 1,777.10 | -0.90% | 37.14% |

(Decrease in price and increase in open interest)

52-week highs

Four stocks in the BSE 500 universe — the broadest index on the bourse — touched the milestone: Cipla, Cochin Shipyard, Gujarat Fluorochemicals and RITES.

52-week lows

On the other hand, 13 stocks hit 52-week lows:

| ALOKTEXT | LICI |

| BSOFT | MEDPLUS |

| DHANUKA | SANOFI |

| IEX | SHILPAMED |

| INDOCO | SYMPHONY |

| INTELLECT | ZENSARTECH |

| IOC |

First Published: Sept 29, 2022 7:22 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Exclusive: FM Nirmala Sitharaman says poverty alleviation can't be achieved by throwing money at the problem

Apr 18, 2024 7:27 PM

Tamil Nadu Lok Sabha elections 2024: List of Congress candidates

Apr 18, 2024 4:33 PM

Will the payment under PM-KISAN be increased? Here's what Finance Minister said

Apr 18, 2024 3:58 PM