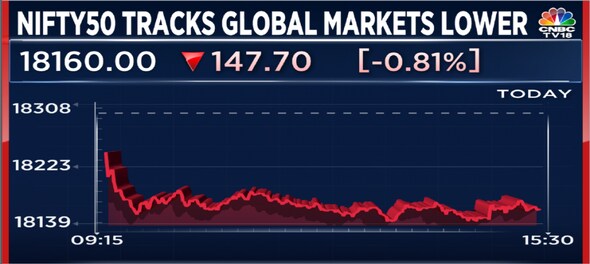

Indian equity benchmarks fell on Monday, extending losses to a third straight session, dragged by losses in financial, IT, oil & gas and metal shares. A sell-off across most major markets around the globe on fears of a global slowdown owing to fresh COVID restrictions in China sent negative signals to Dalal Street.

What do the charts suggest for Dalal Street?

The Nifty50 has formed a long negative candle on the daily chart, reflecting the ongoing correction in the market, according to Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

The 50-scrip index has given up immediate support of the previous month, at its 10-day exponential moving average, at 18,250, he pointed out.

Key support for Nifty Bank stands at 42,000

"The Nifty Bank has continued to reflect a tug of war between the bulls and the bears, forming a doji candle on the daily chart," said Kunal Shah, Senior Technical Analyst at LKP Securities.

The index fell 0.2 percent to settle at 42,346.6 on Monday — within 300 points of an all-time high touched last week.

Shah sees lower support for the banking index at 42,000. "The bears are forming a grip around the 42,500-42,600 zone, a level if breached will lead to a sharp short covering move towards 43,500-44,000 levels," he said.

Here are key things to know about the market ahead of the November 22 session:

SGX Nifty

On Tuesday, Singapore Exchange (SGX) Nifty futures — an early indicator of the Nifty index — gained as much as 61 points or 0.3 percent to 18,266 ahead of the opening bell on Dalal Street.

Global markets

Equities in other Asian markets largely slipped on Tuesday, with a weak handover from Wall Street. MSCI's broadest index of Asia Pacific shares outside Japan was down 0.3 percent at the last count.

Japan's Nikkei 225 was up 0.7 percent, but China's Shanghai Composite was down 0.1 percent and Hong Kong's Hang Seng down 1.1 percent.

S&P 500 futures edged 0.1 percent higher. On Monday, the S&P 500 fell 0.4 percent, the Dow Jones 0.1 percent and the tech stocks-heavy Nasdaq Composite 1.1 percent.

What to expect on Dalal Street

HDFC Securities' Shetti believes the Nifty has switched to a negative short-term trend.

"The index is approaching a crucial support zone around 18,100-18,000 levels, which is expected to be a make-or-break level for the market. A failure to stage a sustainable bounce is likely to open sharp weakness in the market," he said.

Key levels to watch out for

The maximum call open interest is accumulated at the strike price of 18,300, with 2.4 lakh contracts, and the next highest at 18,400, with 2.2 lakh contracts, according to provisional exchange data. The maximum put open interest is at 18,000, with 1.4 lakh contracts, and at 17,900 and 17,500, with one lakh each.

This suggests strong resistance at 18,300 and a key cushion at the 18,000 mark.

FII/DII activity

Foreign institutional investors (FIIs) remained net sellers of Indian shares for a second trading day on Monday, according to provisional exchange data.

Long build-up

Here's one stock that saw an increase in open interest as well as price:

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| ESCORTS | 964,150 | 2,190 | 7.68% | 14.35% |

Long unwinding

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| OBEROIRLTY | 5,590,200 | 890 | -0.86% | -54.51% |

| PIDILITIND | 2,629,000 | 2,665.65 | -1.31% | -44.92% |

| IRCTC | 10,983,875 | 716.9 | -0.08% | -44.20% |

| TRENT | 4,856,050 | 1,385.40 | -0.14% | -43.37% |

| ADANIPORTS | 64,738,125 | 871 | -2.18% | -42.29% |

(Increase in price and decrease in open interest)

Short covering

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| INTELLECT | 4,767,000 | 445 | 0.82% | -49.76% |

| ABCAPITAL | 22,221,000 | 126.4 | 0.88% | -48.07% |

| RAMCOCEM | 4,389,400 | 665.65 | 2% | -42.49% |

| AARTIIND | 2,780,350 | 669.85 | 2.98% | -41.73% |

| MUTHOOTFIN | 7,230,750 | 1,059.50 | 0.12% | -41.20% |

(Increase in price and decrease in open interest)

Short build-up

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| TATASTEEL | 67,838,500 | 104.8 | -1.64% | 109.64% |

(Decrease in price and increase in open interest)

52-week highs

Fourteen stocks in the BSE 500 universe — the broadest index on the bourse — touched the milestone:

| BANKINDIA | IIFL | PSB |

| BHARTIARTL | INDIANB | TIMKEN |

| CENTRALBK | JBCHEPHARM | UCOBANK |

| ESCORTS | MAHABANK | UNIONBANK |

| GESHIP | PNB |

52-week lows

On the other hand, 11 scrips hit 52-week lows:

| BANDHANBNK | MOTILALOFS | SONACOMS |

| DELHIVERY | QUESS | SUDARSCHEM |

| GLAXO | SANOFI | VOLTAS |

| INDIGOPNTS | SIS |

First Published: Nov 21, 2022 11:38 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM