After two weeks of gains, India's benchmark indices dropped 1 percent each in the week gone by, led mainly by technology names which are facing a renewed bout of selling pressure. The Nifty IT fell over 6 percent last week.

33 of the Nifty 50 constituents ended the week with losses. PSU Banks continued their outperformance with the index ending with gains of nearly 5 percent for the week.

Among other outperformers last week were FMCG names like HUL, Nestle, and Asian Paints, while Axis Bank and L&T completed the list. Yes Bank, Madras Fertilisers, Jindal Stainless and Bank of Baroda featured among the top gainers within the broader markets.

In an interaction with CNBC-TV18 on Friday, Sunil Subramaniam of Sundaram Mutual Fund said that a lot of existing investors are booking profits as they worry over the clear market direction with the world heading into a recession. "So I think there's some bit of healthy profit booking, which I think is fine, because they will work on the sidelines and then probably wait for the right time to re-enter," he said.

What do the charts suggest for Dalal Street?

Nagaraj Shetti, technical research analyst at HDFC Securities expects more weakness in the short term for the Nifty 50 as it formed a long negative candle on its daily chart with minor lower shadow. "Technically, this pattern indicates downside breakout of the range bound movement of the last few sessions," he said.

Kunal Shah of LKP Securities witnessed short positions being built up at higher levels for the Nifty Bank index which has outperformed the Nifty 50 recently. According to him, the index trades in a broad range of 43,000 to 44,000, where a significant amount of put and call writing has been witnessed respectively. "The index must decisively breach the range for a trending move on either side," he said.

Also Read: Paytm’s befuddling buyback move | Bottomline

Here are key things to know about the market ahead of the December 12 session:

SGX Nifty

On Monday, Singapore Exchange (SGX) Nifty futures — an early indicator of the Nifty index — declined 32 points points or 0.17 percent to 18,559, thereby pointing to a flat to negative opening for the market.

Global Markets

Benchmark indices posted another day of losses on Wall Street with the Dow Jones shedding another 300 points, taking the total weekly loss to 2.8 percent. This was the worst week for the index since September. Both the S&P 500 and the Nasdaq fell 0.7 percent each. For the week, both indices were down nearly 4 percent.

The focus now shifts to the US Federal Reserve, which is likely to deliver a 50 basis points rate hike at the end of its December meeting on Wednesday.

What to expect on Dalal Street

Siddhartha Khemka of Motilal Oswal Financial Services expects the consolidative mode in the market to continue until central banks like the Fed, ECB and the Bank of England come out with their policies next week. He also expects weakness in tech stocks to continue, while FMCG may do well on the back of falling commodity prices and better demand.

Support for the Nifty in the coming week is placed in the range of 18,550 - 18,380, according to Ruchit Jain of 4Paisa.com. If the index breaches the support range, it may see a price-wise corrective action towards 18,100. On the other hand, if the support is held, it may lead to a pullback towards levels of 18,650 and 18,730.

Key levels to watch out for

For the weekly options expiry on December 15, the 18,800 strike call of the Nifty 50 has added 31.85 lakh shares in Open Interest, followed by the 18,700 call, which added 57.13 lakh and 18,600 call which added 69.52 lakh.

On the downside, the 18,400 strike put added 17 lakh shares in Open Interest, followed by the 18,300 put and the 18,200 put, which added 14.6 lakh and 21 lakh shares respectively in Open Interest.

Among stocks, GNFC remains in the F&O Ban while stocks like PNB, Delta Corp, and BHEL are new entrants to the F&O Ban. Indiabulls Housing Finance will exit the ban from today's trading session.

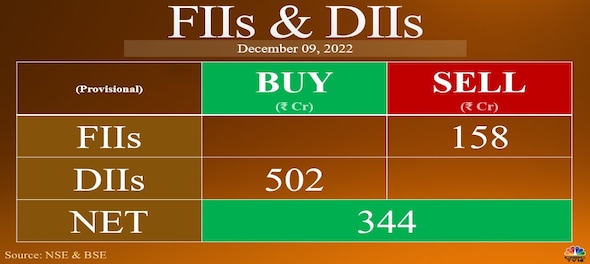

FII/DII activity

FPIs invested Rs 36,238 crore in Indian equities for the month of November, according to NSDL Data. Big buying was seein in financial services, capital goods, auto and auto components.

VK Vijayakumar, Chief investment strategist at Geojit Financial Services believes that although India will continue to attract financial capital, the high valuations will be a deterrent.

"Going forward, in the near term, FPIs are likely to make only modest purchases in performing sectors and may continue to sell and book profits in sectors where they are sitting on big profits. More money is likely to move into cheaper markets," he said.

Long build-up

Here are five stocks that saw an increase in open interest as well as price:

| Stocks | Current OI | CMP | Price Change | OI Change |

| Cummins India | 22,92,000 | 1,512.25 | 3.31% | 35.85% |

| AU Small Finance Bank | 79,36,000 | 679.00 | 1.21% | 7.77% |

| HDFC | 1,50,95,400 | 2,691.45 | 0.17% | 4.75% |

| Gujarat Gas | 48,83,750 | 521.20 | 0.08% | 4.21% |

| Nestle India | 2,77,640 | 20,354.90 | 1.95% | 2.09% |

Short build-up (Decrease in price and increase in open interest)

| Stocks | Current OI | CMP | Price Change | OI Change |

| HCL Tech | 1,13,91,800 | 1,033.05 | -6.81% | 19.96% |

| Metropolis Healthcare | 9,31,200 | 1,425.00 | -0.97% | 6.92% |

| Honeywell Automation | 34,620 | 41,820.00 | -0.36% | 5.82% |

| Havells India | 47,07,000 | 1,191.00 | -2.53% | 5.42% |

| LTI-Mindtree | 19,85,250 | 4,433.90 | -3.55% | 5.32% |

Short Covering (Increase in price and decrease in open interest)

| Stocks | Current OI | CMP | Price Change | OI Change |

| Bank of Baroda | 8,68,37,400 | 189.80 | 0.74% | -8.76% |

| Siemens | 19,46,725 | 2,985.85 | 0.75% | -7.74% |

| Eicher Motors | 31,65,225 | 3,369.00 | 0.56% | -5.54% |

| Marico | 82,34,400 | 526.60 | 2.43% | -4.14% |

| Glenmark | 54,80,900 | 437.00 | 0.41% | -3.52% |

Long Unwinding (Decrease In Price & Open Interest)

| Stocks | Current OI | CMP | Price Change | OI Change |

| Polycab | 8,55,600 | 2,736.50 | -0.24% | -8.12% |

| Hindalco | 1,79,82,600 | 465.50 | -1.35% | -7.25% |

| Apollo Tyres | 1,34,78,500 | 317.30 | -0.58% | -7.20% |

| Navin Fluorine | 4,35,600 | 4,380.05 | -0.95% | -6.07% |

| Oracle Financial | 5,50,800 | 3,057.95 | -2.04% | -5.62% |

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Pilibhit Lok Sabha Election 2024: Three-way battle unfolds in historic constituency

Apr 19, 2024 7:00 AM

Nitin Gadkari seeks hat-trick victory in Nagpur Lok Sabha battle against Congress' Vikas Thakre

Apr 19, 2024 6:59 AM

Lok Sabha Elections 2024 Live Updates Phase One: Voting begins, fate of 1,625 candidates in 102 seats will be sealed today

Apr 19, 2024 6:17 AM

Lok Sabha election 2024: A SWOT analysis of DMK vs AIADMK in Tamil Nadu

Apr 19, 2024 1:22 AM