The sharp market rally post March 2020 triggered majority stocks from their low levels to hit 52-week highs. There are still listed companies with fundamentally strong numbers that are trading much lower than fair value. Yes Securities has listed out 5 stocks with high the possibility of a market reward given their attractive valuations and strong fundamentals.

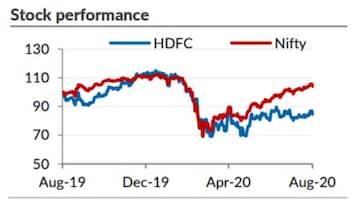

1. HDFC Ltd:

The domestic brokerage feels that the core mortgage business is available at inexpensive valuations of 1.6x P/BV (price-to-book value) after adjusting value of its banking, insurance and asset management businesses.

Source: Yes Securities Report

Source: Yes Securities ReportThe asset quality challenges is short-lived and a new business cycle could take shape from FY22 driven by major tailwinds of decade-low interest rates, upswing in economy and benign funding environment, added the brokerage. Also, well-buffered balance sheet and P&L along with high capital ratios will cushion asset quality concerns, the report added.

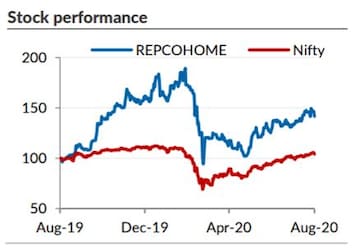

2. Repco Home Finance: The home financier currently stands at a strong valuation at 0.6x P/ABV and 3.6x P/E on FY22 estimates. The near-term challenge is the operating environment, but the current low valuations will ease it out, said Yes Securities report.

Source: Yes Securities Report

Source: Yes Securities ReportAccording to the report, the balance sheet is well-cushioned with 100 percent retail portfolio, Tier-1 capital of 26 percent , low leverage at 6.1x, healthy ECL coverage on Stage-3 assets, robust profitability and increasing granularity of loan portfolio.

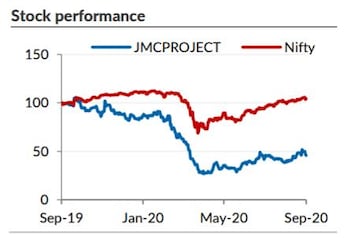

3. JMC Projects (India): COVID-19 related shutdown has impacted the business, however the execution is picking up again and the company will be able to make up for significant part of the revenue, explained the brokerage.

Source: Yes Securities Report

Source: Yes Securities ReportAlso, the company is expected to invest Rs 500 million in its road BOT assets during FY21. The net debt at FY21-end is likely to remain at current levels. New orders would also contribute to revenues in H2FY21 and FY22, the report explained. At the current market price, the stock is trading at an attractive

valuation of 7x FY22E (Standalone) P/E ratio (price-to-earnings).

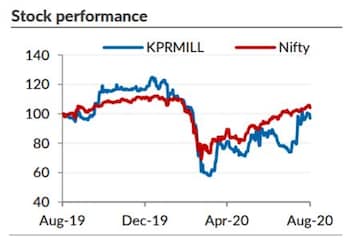

4. KPR Mill: It is an integrated textile player that has competitive advantages due to its transport cost and shared expenses. Most of its textile plants/garment units are located at <50 km radius, which helps in overcoming large transportation costs, said the brokerage report.

Source: Yes Securities Report

Source: Yes Securities ReportIt further said that it's garmenting revenue has increased from 28 percent in FY17 to 42 percent in FY20, and this will continue in future. "Given robust fundamentals, the stock is trading at an attractive valuation of 7.5x FY23E P/E and 5.3x FY23E EV/EBIDTA," added the report.

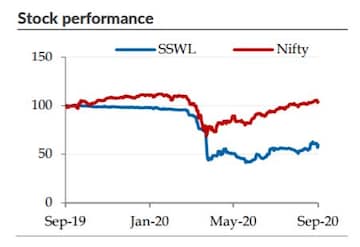

5. Steel Strips Wheels: The steel and alloy wheel rims company has strong relationship with Tata Motors and Sumitomo Metal Industries. It commands market share of 50 percent in passenger cars, 44 percent in tractors, 53 percent in commercial vehicle and 70 percent in OTR (off-the-road) vehicle tyre market, said the brokerage.

Source: Yes Securities Report

Source: Yes Securities ReportThe stock is trading at an attractive valuation of 7x FY23E P/E and 5X FY23E EV/EBITDA. According to the report, the company is well-placed on the back of higher margin contribution, scrappage policy implementation and anti-dumping duty on Chinese wheels.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM