Home

Terms and Conditions

Stock Market Highlights: Sensex sheds 949 points, hits 3-month low; Airtel, TCS drop 3%

Live Updates

Thank you, readers! That's all from CNBC-TV18.com's live market coverage on December 6. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Expect bounceback in Nifty50 below critical support zone of 16,800-16,700: Swastika Investmart's Santosh Meena

Santosh Meena, Head of Research at Swastika Investmart, believes the market may continue to be volatile amid news flow related to the Omicron variant of the coronavirus. "Technically, a critical support zone for the Nifty is at 16,800-16,700 levels where we can expect a bounceback. Below those levels, 16,400 will be the next important support level. On the upside, 17,000 will act as immediate intraday resistance on Tuesday. The next hurdle for the Nifty will be at the 100-day moving average of 17,181; above its 100-day moving average, we can expect a short covering move towards the 17,300-17,350 zone," he said.

Rise in COVID cases has once again started to haunt global markets: Religare Broking's Ajit Mishra

Ajit Mishra, VP-Research at Religare Broking, said the rise in COVID cases has again started to haunt the global markets. He said the situation may deteriorate further in the near future.

"Besides, the upcoming outcome of the MPC policy review and macroeconomic data (IIP and CPI inflation) would keep volatility high. We reiterate a cautious stance and suggest continuing with a hedged approach," he said.

In no hurry to go long on PVR now: Dilip Bhat

Dilip Bhat, Joint MD of Prabhudas Lilladher, is not upbeat about PVR shares at the moment, and says one can possibly take a momentum play on the stock.

"As far as this company and this sector is concerned, it has been pretty badly ambushed by the kind of news that is coming out of the pandemic. And time and again, we have seen how it has taken a toll on this particular sector and this company in particular. More importantly, they have been making huge cash losses every quarter and they are funding it by way of raising further equity. My own sense is that from the current levels, I will not be in a hurry to buy this particular stock," he said.

Vodafone Idea can rise further 50-60%: Prabhudas Lilladher's Dilip Bhat

Dilip Bhat, Joint MD of Prabhudas Lilladher, sees more upside, of about 50-60 percent, in Vodafone Idea going forward. "A lot of the talks had been going around now for the last maybe one and a half to two years. And possibly at every time when it goes up, some of these get accentuated a lot more and some of the more positive out of that comes into the play. But surely, I think the government support is the biggest tailwind for this particular stock. And of course, I think the market is once again roaring with the news that possibly a good strategic investor will come in... will invest," he said.

"Everybody's expecting that the Birlas will do something about it. And with that expectation, and with ARPUs improving, I think all sorts of tailwinds have started in this telecom sector. So, possibly, Vodafone Idea is also playing on that... So I'm pretty optimistic about the outcomes of some of the developments as far as Vodafone Idea is concerned," he added.

Positive on Indian Oil, Bharat Petroleum: Hemang Jani

Hemang Jani of Motilal Oswal Financial Services is comfortable entering names such as Indian Oil and Bharat Petroleum on any correction. "On OMCs as a space, there is no additional uncertainty in terms of them not being able to take the price hike but due to volatility in crude price, you might see a bit of negative sentiment. However overall we feel that there is a liking for some of the PSU names particularly names like IOC and BPCL,” he said.

Jani likes ICICI Bank, UltraTech, Bharti Airtel and Titan from the largecap space, and Zensar Technologies, APL Apollo Tubes and Ramco Cement from the midcap space. "These are the names that one can look at buying into in the correction phase that we are going through,” he said.

Expect RBI to stay accommodative in upcoming review: Vinod Nair

Vinod Nair, Head of Research at Geojit Financial Services, expects the RBI to hold on to its 'accommodative' stance of policy in the upcoming review given the short-term uncertainties. "The ambiguity surrounding Omicron continued to dent the morale of domestic investors ahead of the important RBI policy announcement on Wednesday... However, a change in stance is expected during H1 2022," he said.

Any bounce in Nifty50 to be capped at 17,200-17,250 resistance: Manish Shah

Independent technical analyst believes any bounce in the Nifty will be capped in the resistance zone of 17,200-17,250 in the near term. "Selling in the index intensifies. With such a large range in the last two days, Nifty should trade below the minor swing low at 16,780, and could see a decline towards 16,700-16,900 levels now," he said.

Market At Close | Frontline indices at over 3-month lows

Here are some highlights:

--BSE cos erase market cap of Rs 4.5 lakh crore today, nearly Rs 15 lakh crore in 3 weeks

--Market erases last week’s gain

--Nifty midcap index slips 433 points to 29,863, Nifty Bank slides 461 points to 35,736

--Except UPL, all Nifty stocks close lower; IndusInd, Tata Consumer, Bharti Airtel top losers

--Metal stocks fail to hold on to intraday gains; Tata Steel, JSW 3% off highs

--Unlock stocks continue downmove amid Omicron concerns; PVR falls 6%

--IT remains weak; Nifty IT top losing index, falls over 2%

--VIX up 10%

--Vodafone Idea, Zee gain

--Indiabulls Housing, Indus Towers, L&T Infotech, Coforge, Syngene top midcap losers

--Market breadth favours bears; advance-decline ratio at 1:2

Market At Close | Nifty Bank sheds 461 points to 35,736

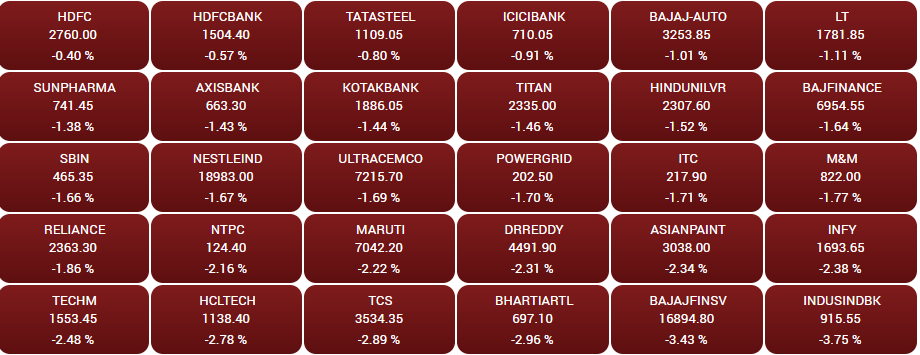

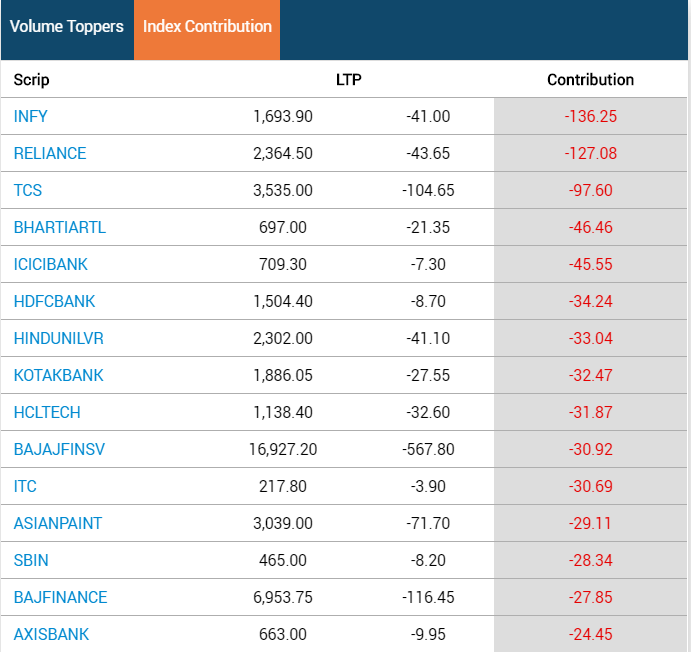

IndusInd, Tata Consumer, Bajaj Finserv, Bharti Airtel, TCS top blue-chip laggards

Forty nine out of the 50 Nifty stocks ended in the red. UPL was the only gainer in the pack, ending 0.4 percent higher. (Check out stocks that moved the most on December 6)

Closing Bell | Sensex sheds 949 points, Nifty50 drops to 16,912

The 30-scrip index tumbled 949.3 points or 1.7 percent to end at 56,747.1 and the broader Nifty50 benchmark settled at 16,912.3, down 284.5 points or 1.7 percent from its previous close. Losses across sectors, led by IT, financial, consumer and oil & gas shares, dragged the headline indices lower.

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|