Home

Terms and Conditions

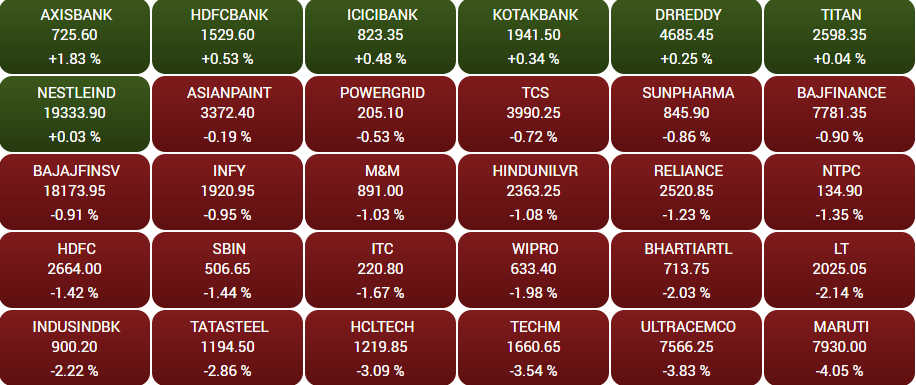

Stock Market Highlights: Sensex ends 554 pts lower, Nifty below 18,150; Maruti, UltraTech fall 4%

Live Updates

Thank you, readers! That's all from CNBC-TV18.com's live market coverage on January 18, 2022. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Bears taken control of market for short term: Gaurav Ratnaparkhi

Gaurav Ratnaparkhi, Head of Technical Research at Sharekhan by BNP Paribas, said the index breached the near-term support zone of 18,150-18,120, where there were multiple short-term support parameters. "On the daily chart, the Nifty has formed a bearish outside bar along with an engulfing bear candle. This shows that the bears have now taken the control for the short term," he said.

Going ahead, he sees near-term support at 18,000 below which, the index can plunge towards 17,700. On the other hand, Tuesday's high of 18,350 now becomes a crucial short-term barrier," he said.

Some correction cannot be ruled out for Nifty50: Ruchit Jain

Ruchit Jain, Lead Research at 5paisa.com, believes some correction within an uptrend cannot be ruled out for the Nifty. The last hour sell-off resulted in a close below its 20-day exponential moving average for the index after almost a month, he said. "This certainly has applied some brakes to the recent momentum... Immediate support for Nifty is placed around 18,000 given that there are decent positions in the 18,000 put option in both weekly as well as monthly series. In case 18,000 does not hold, we could see this correction getting extended towards the 20-day exponential moving average, which is placed at 17,800. On the flipside, 18,300-18,350 will now be seen as immediate resistance for the Nifty," he said.

"Although we may see a short-term correction towards the above mentioned levels, it should be construed as a corrective phase within an uptrend as the recent upmove seems impulsive, and hence, positional traders can look for buying opportunities in this downmove. However, intraday traders could have to deal with higher volatility, and hence they should avoid aggressive positions and trade with proper risk management," he added.

Rupee may drift lower towards 75.20 vs dollar in coming days: Sugandha Sachdeva

Sugandha Sachdeva, VP-Commodity and Currency Research at Religare Broking, sees the rupee drifting lower towards 75.20 against the greenback in the coming days. "The rupee has come under pressure amid a rebound in the dollar from two-month lows and a relentless upside in Crude oil prices, which have surged by close to 13 percent since the beginning of the year. Another headwind for the domestic currency is the rising trade deficit, which has widened by 37.92 percent on a year-on-year basis in December 2021. The threat of aggressive rate increases by the US Fed looks to further weigh on the Indian rupee," she said.

Margins under pressure owing to higher wages: Sonata Software

Sonata Software delivered a healthy set of Q3 numbers. IT services revenue growth was at 8.6 percent on a constant currency basis, but the margin performance was muted.

Jagannathan Chakravarthi, CFO of Sonata Software, spoke to CNBC-TV18 on the earnings fineprint. (Read more)

Your Stocks | DMart, Dr Reddy's, Maruti, HDFC Life in focus

Parthiv Shah, Director at Tracom Stock Brokers, and Vaishali Parekh, Head of Technical Research at Prabhudas Lilladher, answered all stock- and investment-related queries on your own CNBC-TV18 show, Your Stocks. (Watch)

Will look to monetise ad inventory in cricket, sports: Nazara Tech

Nazara Technologies will look to monetise its ad inventory in cricket and sports going forward, CEO Manish Agarwal said in an interview to CNBC-TV18. The mobile gaming company is set to acquire a 55 percent stake in ad-tech firm Datawrkz for Rs 124 crore.

Agarwal said this is Nazara's fifth merger & acquisition deal since its IPO. (Read more)

Dixon BoAt Tie-Up | Marketing, sales to be handled by Imagine, says Atul Lall

Imagine Marketing - the maker of boAt audio products along with Dixon Technologies - has signed a joint venture agreement to design and manufacture wireless audio solutions in India. In an interview to CNBC-TV18, Atul Lall, managing director of Dixon Technologies, and Vivek Gambhir, CEO of Boat, gave the fine print of the deal. (Read more)

Nifty has formed bearish engulfing pattern on daily chart: LKP Securities' Rupak De

Rupak De, Senior Technical Analyst at LKP Securities, believes the Nifty has formed a bearish engulfing pattern as well as a bearish harmonic pattern on the daily chart. "On the higher end, the price found resistance at 18,350 which resulted in a sharp fall towards 18,080... Momentum oscillator RSI has entered a bearish crossover. On the higher end, resistance is visible at 18,350-18,400 levels, and support is visible at 18,000-17,850 on the lower end," he said.

This is a 'buy on dips' market: Julius Baer's Rupen Rajguru

Rupen Rajguru, Head-Equity Investment and Strategy at Julius Baer, continues to believe that it is a 'buy on dips' market for now. "The Indian market is trading at probably say one or almost one-and-a-half standard deviation above its long-term average. Correction is something which everybody has been waiting. We got a bit of correction sometime in December but bounced back. The reason for that is probably India would be the only large economy that is going to have a very strong earnings outlook for next two years as compared to any other country in the world," he said.

Rajguru also said that overall valuations are elevated. "We would definitely wait for a better entry point as far as this market is concerned. But just to conclude from our stance, we remain constructive on the Indian market, because after a long time, we are going to have a pretty strong profit rather earnings cycle. Historically, during those times, the markets do tend to be a lot upward trending and that is what we expect at least over next 2-3 years," he added.

Market At Close | Sensex, Nifty50 fail to hold on to intraday gains

Here are some highlights:

--Auto stocks reverse Monday’s gains; Nifty Auto down 2%

--Private banking stocks lend support; all major private banking scrips in the green

--4 of 5 top Nifty gainers private banks: Axis, ICICI, HDFC Bank, Kotak)

--Nifty Bank sheds 6 pts to 38,210; midcap index down 659 pts at 31,381

--All sectoral indices in the red; realty, auto top losers

--Cement stocks take major beating post-mixed UltraTech earnings

--Grasim, UltraTech, Ambuja, ACC, Ramco Cements fall 3-7%

--Bajaj Finance down over 1% ahead of earnings

--43 Nifty stocks in the red; Tata Consumer, UltraTech, Maruti top losers

--Tech Mahindra down 3% after company announces acquisitions

--Select midcap stocks in the green: PTC, Cholamandalam Investment, ICICI Lombard

--Market breadth favours bears, advance-decline ratio at 2:7

Closing Bell | Sensex down 554 points at 60,755, Nifty50 at 18,113

The 30-scrip index ended 554.1 points or 0.9 percent lower at 60,754.9 and the broader Nifty50 benchmark settled at 18,113.1, down 195.1 points or 1.1 percent from its previous close.

Fabindia IPO | Company likely to file DRHP with SEBI this week, say sources

Ethnic wear retail store chain Fabindia is likely to file preliminary papers with markets regulator SEBI this week for an initial public offering (IPO), sources told CNBC-TV18. (Read more on Fabindia IPO)

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|