Is it a good time to play the recovery theme now? As major paintmakers confirm another round of price hikes to mitigate rising input costs, some say the worst may be behind for the industry.

Positive on the price hikes, most analysts believe the passing on of higher costs to the end consumer should help the paint companies counter recent inflation at least for now. But not many are bullish on the sector as a whole amid alarming valuations.

Asian Paints and Berger Paints confirmed price hikes effective November 12. Nomura said the latest price hike by Asian Paints was larger than its cumulative increases in the past six months.

The price increases come at a time when the industry has been facing headwinds due to a surge in key raw material, primarily crude oil and its derivatives.

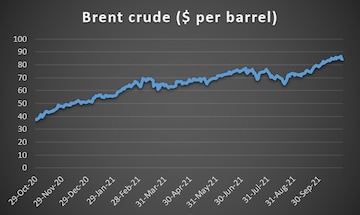

Crude oil has surged 62.8 percent on a year-to-date basis, riding on rising demand amid limited supply.

Here's how the crude oil benchmark has moved in the last one year:

Paintmakers have lost their appeal on Dalal Street in the recent past.

| Stock | Return (%) | PE (LTM) | |||

| One month | Three months | Six months | One year | ||

| Asian Paints | -6.7 | 3.4 | 18.6 | 39.3 | 92.3 |

| Berger Paints | -9.3 | -12.3 | 3.8 | 17.7 | 94 |

| Kansai Nerolac | -14.1 | -12.1 | -4.3 | 6.5 | 53.7 |

| Indigo Paints | -6.6 | -6.8 | 2.3 | ||

| Akzo Nobel | -7 | -6.8 | -5.6 | 6 | 31.5 |

| Shalimar Paints | -2.5 | -17.6 | 2.1 | 26.5 | -8.5 |

Indian equity benchmark Nifty50 has risen 27.7 percent in 2021 so far.

Dalal Street was disappointed with Asian Paints' Q2 show, as its quarterly revenue topped expectations but profit fell short of estimates by a wide margin. The company's net profit as well as EBITDA performance missed expectations, as its cost of material consumed jumped 72.7 percent.

"In Q2, market leader Asian Paints’ gross margin declined by 966 basis points to 34.7 percent as the company refrained from taking aggressive price hikes in a bid not to spoil the current demand trend in the market. A similar trend was seen in Kansai Nerolac paints also," Geojit Financial Services Analyst Antu Eapen Thomas told CNBCTV18.com.

Kansai Nerolac posted a 45.3 percent drop in net profit to Rs 92 crore for the July-September period, even though revenue rose 17.1 percent to Rs 1,619.6 crore. Other paintmakers are yet to post their quarterly numbers.

He expects demand to remain robust due to:

Any volatility in crude prices will add pressure on paint companies' margins, said Thomas. "Due to the unprecedented trend in raw material prices, the input cost as a percentage of revenue was increased to 65 percent compared to 50-55 percent," he said. The analyst feels Asian Paints' valuation is elevated, but expects it to moderate on account of margin pressure.

Will the price hikes help investors take their mind off the earnings miss?

Experts see a huge opportunity in paints in the country with the industry expected to register double-digit growth going forward. Demand conditions in decorative paints continue to be robust across segments driven by a recovery in the economy, still struggling against the fallout from the pandemic.

Market veteran Deven Choksey believes the consumer is willing to spend, keeping the demand scenario intact. "That should come in favour of big companies like Asian Paints, where they have got a very strong franchising for retail customers," he told CNBC-TV18.

Material inflation remains a concern and it remains to be seen whether the company will pass on 100 percent of the higher costs in the coming quarters, said Choksey, who finds the Asian Paints' valuation reasonable.

How to play paint theme now

Varun Singh, FMCG and Retail Analyst at IDBI Capital, is bullish on both Asian Paints and Berger from the space. He believes the benefit of price moves should be visible from the fourth quarter of FY12.

Thomas remains positive on Asian Paints citing its strong balance sheet, pricing power and network expansion.

Price hikes are inevitable for paint and varnish manufacturers as rising costs take a toll on their margins.

The price hikes are sufficient to take care of inflation up to the second quarter of FY22, Singh said.

For instance, Asian Paints took a price hike to the tune of seven percent in the first half of FY22, well below material inflation of around 21 percent, according to Thomas.

"We expect the current high single-digit price hikes to help to mitigate the inflationary pressure on input costs and add fuels to the stock prices. However, the prevailing valuation is not very attractive which may influence investors to remain cautious in the near term," he said

(Edited by : Abhishek Jha)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha election 2024: A SWOT analysis of DMK vs AIADMK in Tamil Nadu

Apr 19, 2024 1:22 AM

Exclusive: FM Nirmala Sitharaman says poverty alleviation can't be achieved by throwing money at the problem

Apr 18, 2024 7:27 PM

Tamil Nadu Lok Sabha elections 2024: List of Congress candidates

Apr 18, 2024 4:33 PM

Will the payment under PM-KISAN be increased? Here's what Finance Minister said

Apr 18, 2024 3:58 PM