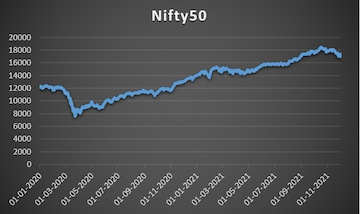

Has the recent correction brought Indian equities' valuations to more reasonable levels? Headline indices are once again showing signs of overheating following a dip, which came after a broad, liquidity-driven rally that lasted 18 odd months.

Investors can use the current juncture as a buy-on-dips opportunity for the long term, and take a stock-specific approach in the short term. That is the message from Sandeep Bhardwaj, CEO-Retail of IIFL Securities.

Bhardwaj expects the Nifty50 to resume the fresh leg of an impulse move once it gets support around 16,300-16,500 levels. "Currently, we view the market as a buy-on-dips one around its 200-day moving average level with a medium- to long-term view... Historically, a buy-on-dips strategy has worked out in rising long-term moving average phases," he said in an interview to CNBCTV18.com.

The 50-scrip benchmark has rallied more than 123 percent since last March 2020, when India first announced a full lockdown to curb the spread of the COVID pandemic. As of December 2, the index has rewarded investors with a 32.5 percent return.

Favourite blue-chips

IT- and healthcare-related shares have been in huge demand over this period, outperforming the heavyweight financial basket.

Bhardwaj is bullish on banking and non-banking financial company stocks as they play a key role in economic growth. "We believe it is likely to do great going forward," he said, suggesting long-term investors to use a buy-on-dips strategy to go long on ICICI Bank, SBI and HDFC Bank. "These companies have been able to manage their asset quality well and are reducing their provisions," he said.

Financial services stocks have the maximum say among sectors when it comes to the movement in blue-chip indices. The space commands the maximum weightage, of almost 37 percent, in the Nifty50 universe, followed by IT shares (17.8 percent).

Asked if one can expect sector rotation in the market now, he replied in the affirmative, saying IIFL Securities has diagnostics and infrastructure sectors under its watch now.

| Index | 12 months (till Dec 2) | 2020 | 2019 | 2018 |

| Nifty50 | 32.5 | 7.9 | 12 | 3.2 |

| Nifty Bank | 24 | -8.4 | 18.4 | 6.3 |

| Nifty Pharma | 11.1 | 51.8 | -9.3 | -7.8 |

| Nifty IT | 62.9 | 41.8 | 8.4 | 23.8 |

| Nifty Healthcare | 20.3 | 49.4 | -6.7 | -5.8 |

"With the rapid increase in government spending to sustain and a pickup in projects awarded, we believe infrastructure as a sector can outperform. As we prepare ourselves for an impending third wave, we expected a rise in the testing activity, favouring many listed diagnostics players," he said.

From the largecap IT basket, he remains bullish on Infosys, HCL Tech and Persistent Systems.

Here's how Bhardwaj's stock picks have fared in the recent past:

| Stock | Return (%) | ||

| Three months | Six months | 12 months | |

| ICICI Bank | -1.1 | 10.2 | 48.7 |

| HDFC Bank | -4 | -0.5 | 9.9 |

| SBI | 9.7 | 7.6 | 84.6 |

| Infosys | 2.1 | 24.9 | 54.1 |

| HCL Tech | -0.3 | 24.7 | 35.9 |

| Persistent Systems | 26 | -33.7 | 29.7 |

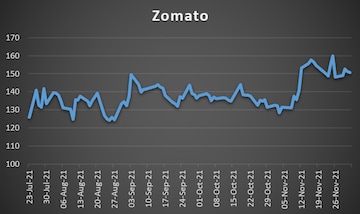

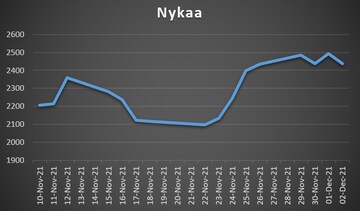

New-age companies

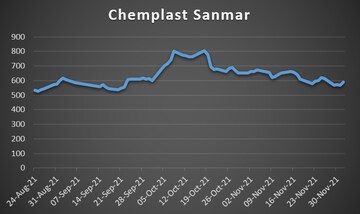

Coming to new-age companies' defence on the valuation front, he said: "Many of these companies have multi-year growth ahead of them, hence one should invest in them selectively. For example, we are bullish on Chemplast Sanmar, which is the largest producer of PVC resins in India and the industry which they operate in have very high entry barriers."

His remarks come at a time when new-age businesses have largely received a robust response from investors, barring Paytm, whose shares continue to recover following a series of losses since its weak listing last month. Paytm parent One97 Communications' market debut is among the weakest in the recent times.

New-age companies cannot be valued by traditional methods, he said. "Most of these companies have historically seen exponential growth due to the networks effect, an increase in revenue through which is very difficult to incorporate into the traditional models."

With time, their true value will come into the picture through market forces, said Bhardwaj.

IIFL Securities is part of the IIFL group, which manages and advises assets to the tune of $50 billion.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Chhattisgarh Lok Sabha elections 2024: Bhupesh Baghel among the list of Congress candidates

Apr 19, 2024 3:45 PM

Chhattisgarh Lok Sabha elections 2024: Full list of BJP candidates

Apr 19, 2024 1:46 PM

Lok Sabha Election Phase One: WB records 51% voting, UP 37%, Maharashtra 32% till 1 pm

Apr 19, 2024 12:56 PM

Violence mars first phase of Lok Sabha polls in West Bengal

Apr 19, 2024 12:09 PM