After a lean patch over 2015-19, the pharma sector this year has outperformed the broader index, and will continue to do so, says IIFL Securities report. It believes that this is an opportune time and COVID-19 is a great catalyst for the sector.

The brokerage explained that the pharma sector enjoyed a profitable phase from 1990 to 2015. Massive growth opportunity in the US (during the 1990-2000 decade) and a slew of launches during 2010-15 were the two times when investors' churned their money into great profits by investing in pharma stocks.

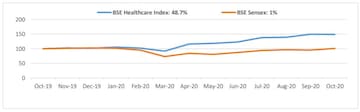

"From February 1999 (inception of BSE Healthcare Index) to October 2015, the BSE Healthcare has outperformed the broader market (Sensex) by an impressive 5.4 percent p.a. In other words, Rs 100 invested in BSE Healthcare grew to Rs 1,696 whereas Rs 100 invested in BSE Sensex grew to Rs 784. A staggering outperformance by any standard. This is without the performance from 1990-1999 which was as stellar if not more," said the report.

Source: IIFL Securities report

Source: IIFL Securities reportAfter 2015, the US FDA became huge trouble for the Indian pharma majors as they started to send out warning letters. Price erosion and increasing competition further intensified the pressure on the companies, resulting in the derating of the sector till 2019.

The entire pharma landscape changed in 2020 as it staged a powerful comeback led by the preference for defensive bets amidst global pandemic, under-ownership in the past, and expected jump in revenues, added the brokerage.

Source: IIFL Securities report

Source: IIFL Securities report"Going ahead, we expect favorable pricing environment in the US for generics, opportunities in the US outside of oral solids, stronger pipeline and new launches, inroads into higher-margin emerging markets and favorable domestic market performance to result in improved RoEs and cash generation," said the report.

It further added that improvement in valuation multiples are likely to sustain and result in sector outperformance against the broader market. Increased PE investment in the sector in 2020 is indicative of a favorable industry outlook.

Investment Idea:

The brokerage suggested Mirae Asset Healthcare Fund, DSP Healthcare Fund, and ICICI Pru Pharma Healthcare & Diagnostics Fund for investors looking to double their wealth.

The top three holdings of Mirae Asset are Dr. Reddy's Labs, Sun Pharma, and Divis Labs. For DSP Healthcare, it's Cipla, Dr. Reddy's Labs, and Ipca Labs. In the case of ICICI Pru, the top three holdings are Cipla, Sun Pharma, and Alkem Labs.

(Edited by : Jomy)

First Published: Nov 4, 2020 3:15 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024 Live: PM panicked after seeing our revolutionary manifesto, says Rahul Gandhi

Apr 24, 2024 9:58 AM

Maharashtra: 258 candidates in fray for 11 seats in third phase, all eyes on Baramati

Apr 24, 2024 8:28 AM