JPMorgan has downgraded Infosys, Tech Mahindra, Mphasis, and Persistent Systems to a ‘neutral’ rating from an ‘overweight’ rating.

The firm has turned more bearish on the IT sector as it expects the margin erosion to persist in the medium-term and stay meaningfully below the long-term averages. The firm also sees limited incremental margin levers going ahead.

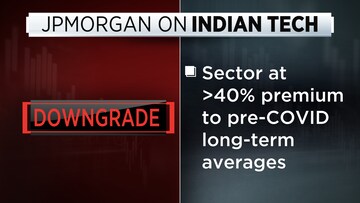

The report states that the Indian IT names, even now, are trading at more than 40 percent premium to the pre-COVID long-term averages and that too when the peak growth is behind and the margins are structurally getting eroded. This is the primary reason why JPMorgan has turned bearish and downgraded all the remaining overweight stocks within the IT names to neutral. It believes that any meaningful upside from here should be a rally to exit into the IT names in India.

At the time of publishing (11:40 am) the IT sector was under pressure due to the valuation concerns raised by brokerages and the JP Morgan downgrade.

Watch the accompanying video for more

To watch other videos in this series, click on the Standout Brokerage Report tab below.

(Edited by : Abhishek Jha)