Despite the recent sell-off on Dalal Street, Indian valuations remain quite high among Asian peers. That is the view coming in from Manishi Raychaudhuri, Asian Equity Strategist, Equity Cash-Asia Pacific, BNP Paribas. In an interaction with CNBC-TV18, he said the Nifty50 benchmark is trading at a premium over global peers and the valuation gap between valuations in India and other Asian markets remains quite high.

"The Nifty is trading at about 18-18.5 times one year forward, which is still about 15-20 percent higher than its long-term average in the last 10-15 years.... The premium still remains higher than what it has been on an average of the long term," he said.

BNP Paribas is 'overweight' on Indian telecom space. The firm is playing the theme both as a pure-play option and through conglomerates, he said. Among other sectors, the French financial institution will play the auto theme through market leaders and real estate through mortgage lenders, according to Raychaudhuri.

Speaking on IPOs, he said: “Different IPOs come with different fundamentals, different management qualities and different market presence. I would not comment on specific IPOs or stocks, but there is an index, the Indian IPO index, that has been going down secularly for more than a year. I think that has something to do broadly with foreign investors’ sentiment,” he said.

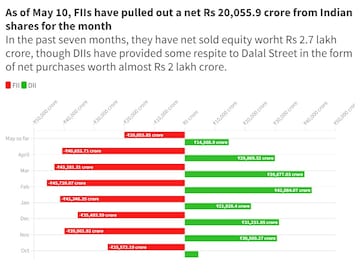

His remarks come at a time when foreign institutional investors have been net sellers of Indian shares for a seven month running.

Talking about Wall Street, he said the Fed has talked about curtailing inflation at any cost.

"BNP Paribas economists believe that there will be four rate hikes of 50 basis points each, of which one has already happened. So three more till about September and possibly, more importantly, there will be quantitative tightening (QT) commencing from June,” he added.

For the entire interview, watch the accompanying video

First Published: May 18, 2022 7:10 PM IST