India assuming the presidency of the G20 for a year starting December 2022 will fillip growth in the travel and hospitality segment, according to brokerage firm Jefferies.

This is likely to aid growth for hotel chains that host foreign dignitaries, such as Indian Hotels, on which Jefferies has maintained its "buy" recommendation but raised its price target to Rs 380 apiece from Rs 325 earlier.

The revised price target implies a potential upside of 17 percent from Friday's closing levels. Shares of Indian Hotels are up 80 percent this year.

Starting December 1, India will assume the presidency of the G20 until November 30, 2023, during which it is likely to host over 200 meetings in various capacities. The G20 Leaders' summit at the level of heads of state or government will be held between September 9 and 10, 2023.

Indian Hotels has been one of the prime beneficiaries of the "unlock" theme after operations were shuttered during the first two waves of the Covid-19 pandemic. The stock gained 60 percent in 2021 as well.

In June, the Taj Group hotel chain disclosed plans to restructure its portfolio under "Ahvaan 2025." Part of the plan was to scale the "Ginger" brand to 125 hotels, Ama Stays and Trails to be a portfolio of 500 and its culinary and home delivery business to expand to over 25 cities.

In a conversation with CNBC TV-18 last week, MD & CEO Puneet Chhatwal reiterated those targets, terming them as achievable. "Currently, our pipeline is north of 65 hotels with 180 in operation. And that's why the target of 300 hotels or 500 homestays is very much realistic over the next four years,” he said. Chhatwal also expects rates to continue to rise amid limited supply while average room rates are also holding up.

Jefferies corroborates Chhatwal's statement by saying that the run rate of occupancies and average room rates are comfortably strong. The trends of leisure demand that picked up post-Covid have sustained, according to the brokerage.

Here are some of the parameters for which Jefferies has increased its assumptions over FY23-25:

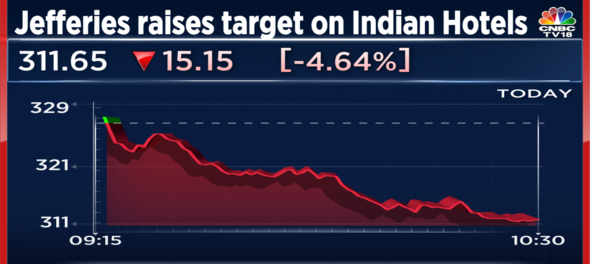

Shares of Indian Hotels are down 4.6 percent at Rs 311.70. The stock is among the top five gainers on the Nifty Midcap index this year.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: BJP's bid for breakthrough in Kerala is an uphill battle, say experts

Apr 23, 2024 9:53 PM

2024 Lok Sabha Elections | PM's Rajasthan speech — has it anything to do with the post-poll mood of the first phase

Apr 23, 2024 3:45 PM

It's KGF 2024 and here's a look at the key characters in Karnataka

Apr 23, 2024 3:17 PM

JP Morgan: Nifty may test 25,000 if BJP wins in 2024 Lok Sabha elections

Apr 23, 2024 2:23 PM