The banking sector has seen one of its best loan growth phases in recent times. The loan growth, for the sector, in Q3FY23 has been around a multi-year high of 17.5 percent a year on year (YoY) and around 4.2 percent quarter on quarter (QoQ).

There have been business updates from a few lenders, which shows that private banks have witnessed strong loan growth momentum and they continue to take the market share away from their PSU counterparts.

The Reserve Bank of India (RBI) has been raising rates, and so have the banks. Hence, one can expect the net interest margins (NIMs) of the banks, to remain stable or improve on a sequential basis given the fact that banks have been raising rates on the lending side in this quarter.

Asset quality will not be an issue. One may see improvement in asset quality with lower slippages and better recovery rates.

So large part of the slippages may come in from restructured book, which is already known. Credit cost or provisions for NPA divided by advances ratio will be lower quarter on quarter, for majority of the players.

Fee income can be strong point this time around given the fact that loan growth has been pretty strong. We may continue to see private banks investing in their franchise, which may keep operating expenses on the higher side. So the cost to income ratio could remain on the higher side.

PSU Banks, may continue to see improvement in their profitability and hence improvement in their return ratios as well.

It is time for mid-sized and smaller banks to report better return ratios than their larger peers in terms of improvement this time around. Hence, the Street may see a record quarter for the banking sector in terms of loan growth, NIMs, low credit cost and low NPAs.

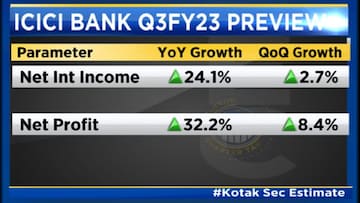

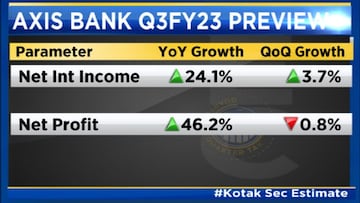

Some of the estimates that have come from Kotak Securities are here.

For HDFC Bank, Kotak Securities has estimated the NII growth of 20.4 percent YoY and about 5.6 percent QoQ.

For ICICI Bank, Kotak Securities expects NIIs at 24.1 percent YoY and 2.7 percent QoQ.

For Axis Bank, Kotak estimates NII growth of 24.1 percent YoY and 3.7 percent QoQ.

Santanu Chakrabarti, India Analyst-BFSI at BNP Paribas, recently spoke to CNBC-TV18 about the current state of the banking industry in India. According to Chakrabarti, private banks in India should not be facing any major challenges when it comes to valuations.

“I don't see any challenge to valuations of private banks, barring any large surprises on asset quality, which look very unlikely,” he said.

Chakrabarti went on to say that the growth of loans in the private banking sector will be driven by an increase in Small and Medium Enterprises (SME), rural, and agriculture loans. This is a positive sign for the industry, as it indicates that these sectors of the economy are expanding and in need of financing.

“Like SME, rural, agri -- these segments will start to do well. So while credit growth will remain high, the relative weightage of segments might change going forward,” he said.

For the entire interview, watch the accompanying video