At a time when crude oil prices are on the rise, some market participants believe Bajaj Auto is a perfectly fine stock to bet on. About 50 percent of Bajaj Auto’s volumes come from exports, with South Africa and Middle East countries being the biggest consumers for the auto major within exports geographies. Soaring crude oil prices and depreciation in Rupee are seen as tailwinds for Bajaj Auto's business.

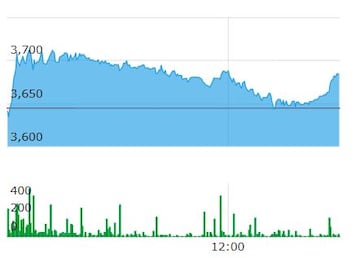

The stock has gained after two days of consecutive fall and rose over 2 percent intraday. The scrip was trading 1 percent higher at Rs 3,680.75 on BSE at 1339 IST.

The stock touched an intraday high of Rs 3,723.9, up 2.18 percent, on BSE today. (Source: BSE)

The stock touched an intraday high of Rs 3,723.9, up 2.18 percent, on BSE today. (Source: BSE)“Higher oil prices would help Middle East countries which are net exporters of crude oil to shore up their revenues, in turn leading to an increase in consumption of all items including automobile vehicles, benefitting the auto-maker,” said Mitul Shah, Head of Research, Institutional Equity at Reliance Securities.

On Friday, the Brent crude oil futures contract for June delivery was above the psychologically crucial level of $100 per barrel. The contract was down 4 percent at $102.83 per barrel as of 1302 IST on Monday.

Another fundamental positive for Bajaj Auto, according to Shah, is that the company bills in dollars, like Information Technology companies. Hence, the depreciation in Rupee seems to be beneficial for the company. Also, increasing the domestic three-wheeler segment and higher market share in the segment is comforting, he added.

Also Read |

For such reasons, Shah believes that Bajaj Auto’s stock is a good bet at this point in time, especially post the recent correction in the stock price. The stock has merely risen one percent in the past month.

A similar view was echoed by Awanish Chandra, Head-Institutional Equities, SMIFS. He believes that the demand outlook for export business is going to remain intact. Around 40 percent of Bajaj Auto’s revenue comes from the export business which is highly profitable.

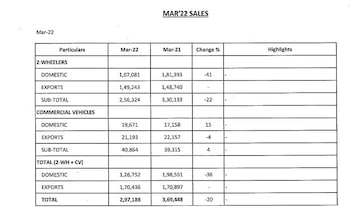

The company's total exports for March came in at 1,70,436 units as compared to the year ago's 1,70,897 units. Meanwhile total sales, including domestic and exports, stood at 2,97,188 units which is a 20 percent YoY decline.

Total sales fell 20 percent YoY in March while exports were flat. (Source: Bajaj Auto's exchange filing)

Total sales fell 20 percent YoY in March while exports were flat. (Source: Bajaj Auto's exchange filing)Another plus point is the recovery in the three-wheelers business. According to Chandra, the auto major will continue to assert its dominance in the 3-wheeler market which will be another advantage for the company as three-wheelers are high margin products for Bajaj Auto.

He is of the opinion that the stock is witnessing buying ahead of the quarterly result, which is due on April 27. The expectation is that the company would report decent earnings and management commentary would reassure investors about Bajaj Auto’s healthy business prospects.

With good results and dividend announcement, Chandra expects the stock may rally up towards the Rs 4,000-mark.

The technical chart shows upward momentum in the stock going ahead, said Kkunal Parar, Vice President-Technical Research, Choice Broking. According to him, the stock may take support at Rs 3,550 level while Rs 4,000 appears to be strong resistance.

First Published: Apr 25, 2022 2:41 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM