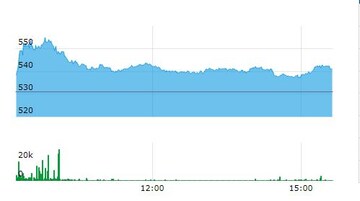

Shares of Aurobindo Pharma gained over 5 percent during trade on Wednesday as brokerages remained bullish on the pharma company's stock, even as they slashed its target price.

The company had posted a 28 percent decline in net profit at Rs 576 crore in the the fourth quarter of fiscal year 2021-22 as compared to Rs 802 crore clocked in the year-ago period.

At close, shares of the drug maker were up 1.90 percent, or 10.10 points higher at Rs 541 on the BSE.

Aurobindo Pharma vice-chairman and managing director K Nithyananda Reddy said the company had performed relatively better in this quarter in spite of the challenging times for the industry.

"We continue to see volume growth in the complex generics segment and are also making significant progress in the complex development programmes, including biosimilars. Further, we are also on track for completing the PLI project as per the committed timelines," Reddy said.

Should you buy Aurobindo Pharma? Here's what brokerages say

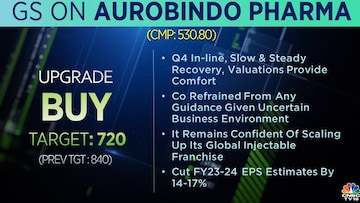

Goldman Sachs cut its target price to Rs 710 from Rs 840 and also slashed its earnings per share estimates by 14-17 percent for FY23-24. However, the brokerage upgraded its rating on Aurobindo Pharma shares to "buy". According to Goldman Sachs, the company's slow and steady recovery and valuations provide comfort.

CLSA maintained its "buy" rating on the pharma company's stock on undemanding valuations and multiple research and developmental projects. However, it too cut the company's target price to Rs 700 from Rs 800 per share.

The brokerage firm said that price erosion remains high for the base business, however, new launches, especially in injectable space, should offset price erosion. R&D pipeline of high-entry-barrier products may deliver from FY24, CLSA added.

Credit Suisse too had an "outperform" call on Aurobindo Pharma's stock, however, the brokerage firm too cut its target price Rs 790 from Rs 855 per share.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM