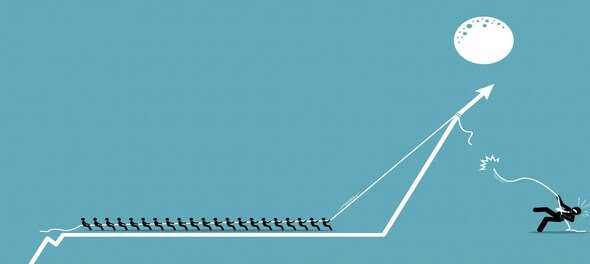

AMTD Digital, a little-known Hong Kong-based tech firm, is making headlines for the extraordinary rally its shares have seen without any apparent reason since its mid-July listing on the New York Stock Exchange (NYSE).

At an IPO price of $7.80 a piece, AMTD Digital's stock price surged to a high of over $2,500 on volumes of a little over 2.5 lakh shares on Tuesday, taking the value of the company to more than $385 billion — higher than Wall Street investment banks such as Morgan Stanely ($149 billion) and Goldman Sachs ($119 billion) and even Chinese tech major Alibaba ($256 billion).

While AMTD Digital has slipped 21 spots to 46th after a sharp more than 34 percent crash in its share price to $1,100 on Wednesday, its market capitalisation is still ahead of Walt Disney ($198.5 billion), Shell ($194.6 billion) and our own Tata Consultancy Services ($154.7 billion), as per companiesmarketcap.com.

Curiously, AMTD Digital’s ticker HKD was one of the most mentioned on Reddit’s WallStreetBets chatroom this week, according to a Financial Times report. The subreddit chatroom, WallStreetBets, has been (in)famous for driving meme stock surges, particularly GameStop, during the first half of 2021, when many hedge funds took heavy losses on short positions.

While there is no definition of meme stocks, a common trend is these stocks defy the underlying fundamentals and often gain on the social media hype that instils FOMO 'fear of missing out' into investors.

Meanwhile, Hong Kong tycoon Li Ka-shing's CK Hutchison Holdings has dissociated itself from the meme stock, although the FT report quoted that AMTD Group, a Hong Kong-based firm that partly owns AMTD Digital, had mentioned on its website that CK Hutchison was a founding member of the group in 2003.

The report added that the web page about CK Hutchison was later taken down.

AMTD Group holds a digital banking licence in Hong Kong, which it bagged in 2019 in a consortium with Chinese tech major Xiaomi. A similar bid in Singapore next year wasn't successful.

First Published: Aug 4, 2022 6:41 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

JP Morgan: Nifty may test 25,000 if BJP wins in 2024 Lok Sabha elections

Apr 23, 2024 2:23 PM

Surat polls: Congress moves EC claiming three proposers of party's candidate may have been abducted

Apr 23, 2024 12:59 PM