Home

Terms and Conditions

Market Highlights: Sensex ends 390 points higher and Nifty 50 above above 18,150

Live Updates

Thank you, readers! That's all from CNBCTV18.com's live market coverage on January 18, 2023. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Stock Market Update | JM Financial Services' Vinay Jaising's view on market

“Last year the world underperformed in absolute terms by between 15 and 20 percent and India was just about flat. However if were to take into account the currency, we were down 10 percent. India is a relative outperformer versus the global indexes. In the first 15 days of 2023, India is still flat but the rest of the world is up between 5-7 percent and China is up 11-12 percent. So there is some catch-up of China opening up, there is some catch-up of FII flows going out of India and going into Korea, Taiwan and China. For 2023, we think the earnings resistivity of India is pretty good, we are pretty resilient especially with banks where we are seeing 13-14 percent CAGR of profit growth. So it is fair to assume 14 percent odd growth in earnings for the Indian market as far as profitability is concerned. Having said that we are looking at India today as more of an absolute market in the next 12 months as compared to relatively cheaper markets in emerging markets and which would get more flows coming in especially in the second half the year when the question of recession go behind us,” says Vinay Jaising, MD, Portfolio Mgmt Svcs JM Financial Services.

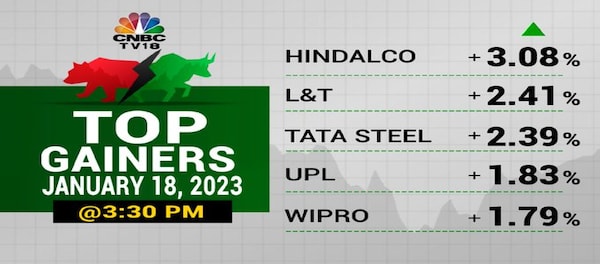

Market at Close | Sensex and Nifty 50 end at 2-week highs

-- HDFC and HDFC Bank lift Nifty on expected FII flows, stocks up two percent each

-- Metal stocks surge on positive brokerage note, Nifty metal top gaining index.

-- Hindalco, Tata Steel, JSPL, SAIL are amongst top gainers in metal basket

-- L&T continues its gaining momentum, ends at record high for 2nd straight day

-- Siemens rises over four percent following Gujarat metro contracts with RVNL.

-- Max Finance builds on to recent gains, ends at a four-month high

-- ICICI Lombard slips four percent after a mixed set of earnings for December quarter.

-- ICICI Pru recovers from lows to close with minor gains on healthy December quarter.

-- Delta Corp reports a weak set of earnings for December quarter, stock closes four percent lower.

-- IndusInd Bank, Persistent end with minor cuts ahead of third quarter earnings

-- Market breadth favours advances, advance-decline ratio at 1:1.

Rupee check | Rupee ends 52 paise higher at 81.24 vs dollar

Highest closing level since December 1, 2022 vs dollar

Stock Market News | Surya Roshni reports December quarter earnings

-- Net profit at Rs 89.7 crore vs Rs 40.5 crore year-on-year

-- Revenue down 0.5 percent at Rs 2,022 crore vs Rs 2,030 crore year-on-year

-- EBITDA up 66.5 percent at Rs 163 crore vs Rs 98 crore year-on-year

-- EBITDA margin at eight percent vs four percent year-on-year

Share Market Update | Stylam Industries reports December quarter earnings

-- Net profit up 53.8 percent at Rs 24 crore vs Rs 15.6 crore year-on-year

-- Revenue up 34.7 percent at Rs 234 crore vs Rs 173.3 crore year-on-year

-- EBITDA up 33.6 percent at Rs 39.4 crore vs Rs 29.5 percent year-on-year

-- Margin at 16.8 percent vs 17 percent year-on-year

Share Market Update | Vikas Lifecare Infra Materials division fetches fresh orders for Rs 160 million

-- The infra products division has bagged fresh orders worth Rs 160 million for the Q4 2022-23.

-- The division has achieved Rs 630 million sales during the current fiscal till December 31 2023.

Stock Market News | Cipla launches testing device for non-communicable and infectious diseases

-- Announced the launch of a point-of-care testing device, Cippoint, that offers a wide range of testing parameters such as diabetes, thyroid function, and cardiac markers, among other health conditions.

-- Expanded its product offerings for diagnostics laboratories and looks to bridge the current gap in the diagnostic ecosystem in India by providing reliable and accurate tests at affordable prices.

-- The testing device offers a wide range of testing parameters including cardiac markers, diabetes, infectious diseases, fertility, thyroid function, inflammation, metabolic markers, and coagulation markers.

-- The device is CE IVD approved – indicating the device is approved by the European In-Vitro Diagnostic Device Directive.

Share Market News | Lupin launches Sacubitril and Valsartan Combination drug for heart failure patients

-- Lupin announced the launch of combination drug Sacubitril and Valsartan under two brand names, Valentas and Arnipin, in India.

-- This drug combination is indicated for patients with Heart Failure (HF) conditions.

-- Valentas and Arnipin tablets are available in 200 mg, 100 mg, and 50 mg.

Share Market Update | Hem Securities' Astha Jain's view on JSW Steel

"I am really very much positive on the metal stock as a whole because global demand is really strong at the present moment of time, which I think is the key driver for their strong future performance. Talking about JSW Steel, we are expecting average sort of results because what happened in this quarter, they will be getting the benefit of lower coking coal consumption prices, but in the longer term, these prices will again be high. So I think that will be a concern in their EBITDA. But the coming quarter will be good for this company and JSW Steel has also been positive factor working for them is their Dolvi plant. So I think that capacity expansion will also be helping this company going ahead. So the future prospects are looking promising, along with the industry tailwind. So I think JSW Steel will perform better in the coming future price target can be set at around Rs 880 and it's a hold candidate for me," says Astha Jain, Hem Securities.

Stock Market News | Newgen Software stock up as CEO believes March quarter to be stronger than December one

In an interview with CNBC-TV18, chief executive officer Virender Jeet said that for the first nine months, the company had broad-based growth across all the markets. (Read more)

Adani Enterprises seeks Rs 20,000 crore in FPO

-- To issue shares on partly paid basis.

-- FPO opens Jan 27 and closes Jan 31.

-- Adani Ent FPO anchor investor bidding date Jan 25.

Stock Market News | CCL Products (India) reports December quarter earnings

-- Net profit up 25 percent at Rs 73 crore vs Rs 58 crore year-on-year

-- Revenue up 26.5 percent at Rs 535.3 crore vs Rs 423 crore year-on-year

-- EBITDA up 8.9 percent at Rs 100.7 crore vs Rs 92.4 crore year-on-year

-- Margin at 18.8 percent vs 21.8 percent year-on-year.

Stock Market News | Buy Usha Martin, Balrampur Chini: Rahul Sharma

Here are two recommendations by Rahul Sharma of Equity99 Advisors:

-- Buy Usha Martin Ltd for a target of Rs 205-210 with a stop loss at Rs 185.

-- Buy Balrampur Chini for a target of Rs 430 with a stop loss at Rs 390.

Stock Market News | Central Bank of India reports December quarter results

-- Profit up 64.3 percent at Rs 458.2 crore vs Rs 278.9 crore year-on-year.

-- NII up 19.9 percent at Rs 3,284.5 crore vs Rs 2,738.4 crore year-on-year.

-- Gross NPA at 8.85 percent vs 9.67 percent quarter-on-quarter

-- Net NPA at 2.09 percent vs 2.95 percent quarter-on-quarter

-- Gross NPA at Rs 18,490 crore vs 19,059 crore quarter-on-quarter

-- Net NPA at Rs 4,061 crore vs Rs 5,407 crore quarter-on-quarter

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|